Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

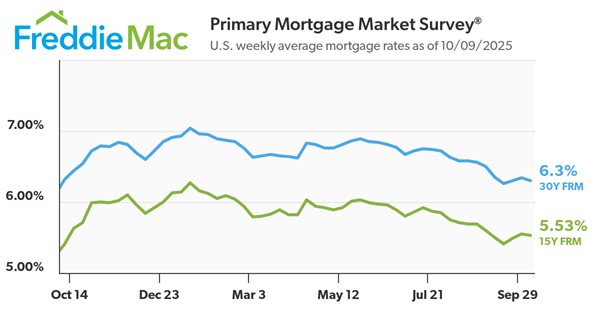

Mortgage Rates Lowest In A Year

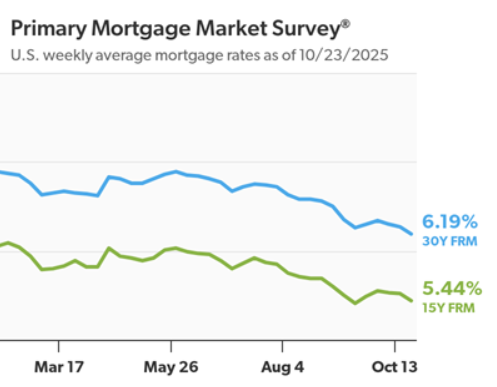

Freddie Mac (OTCQB: FMCC) today released the results of its Primary Mortgage Market Survey® (PMMS®), showing the 30-year fixed-rate mortgage (FRM) averaged 6.19%.

“Mortgage rates continued to trend down this week, hitting their lowest level in over a year,” said Sam Khater, Freddie Mac’s Chief Economist. “At the start of 2025, the 30-year fixed-rate mortgage surpassed 7%, while today it hovers nearly a full percentage point lower. This dynamic has kept refinancings high, accounting for more than half of all mortgage activity for the sixth consecutive week.”

- The 30-year FRM averaged 6.19% as of October 23, 2025, down from last week when it averaged 6.27%. A year ago at this time, the 30-year FRM averaged 6.54%.

- The 15-year FRM averaged 5.44%, down from last week when it averaged 5.52%. A year ago at this time, the 15-year FRM averaged 5.71%.

The PMMS® is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20% down and have excellent credit.

Inching Downward

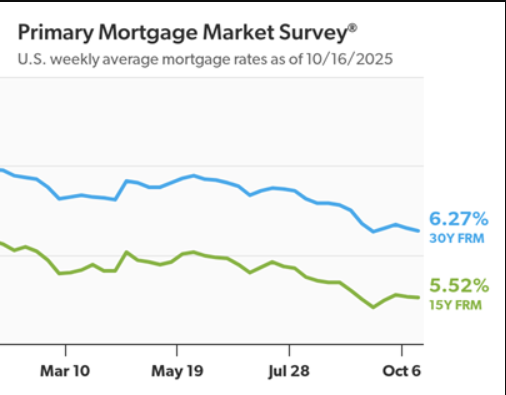

Freddie Mac (OTCQB: FMCC) today released the results of its Primary Mortgage Market Survey® (PMMS®), showing the 30-year fixed-rate mortgage (FRM) averaged 6.27%.

“Mortgage rates inched down this week and have held relatively steady over the past several weeks,” said Sam Khater, Chief Economist at Freddie Mac. “Importantly, homeowners have noticed these consistently lower rates, driving an uptick in refinance activity. Combined with increased housing inventory and slower house price growth, these rates also are creating a more favorable environment for those looking to buy a home.”

- The 30-year FRM averaged 6.27% as of October 16, 2025, down from last week when it averaged 6.30%. A year ago at this time, the 30-year FRM averaged 6.44%.

- The 15-year FRM averaged 5.52%, down from last week when it averaged 5.53%. A year ago at this time, the 15-year FRM averaged 5.63%.

The PMMS® is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20% down and have excellent credit.

30-Year Fixed Mortgage Rates Average 6.30%

Freddie Mac (OTCQB: FMCC) today released the results of its Primary Mortgage Market Survey® (PMMS®), showing the 30-year fixed-rate mortgage (FRM) averaged 6.30%.

“Mortgage rates decreased this week,” said Sam Khater, Freddie Mac’s Chief Economist. “Over the last few weeks, mortgage rates have settled in at their lowest level in about a year. There is growing evidence that homebuyers are digesting these lower rates and gradually are willing to move forward with buying a home, which is boosting purchase activity.”

- The 30-year FRM averaged 6.30% as of October 9, 2025, down from last week when it averaged 6.34%. A year ago at this time, the 30-year FRM averaged 6.32%.

- The 15-year FRM averaged 5.53%, down from last week when it averaged 5.55%. A year ago at this time, the 15-year FRM averaged 5.41%.

The PMMS® is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20% down and have excellent credit.

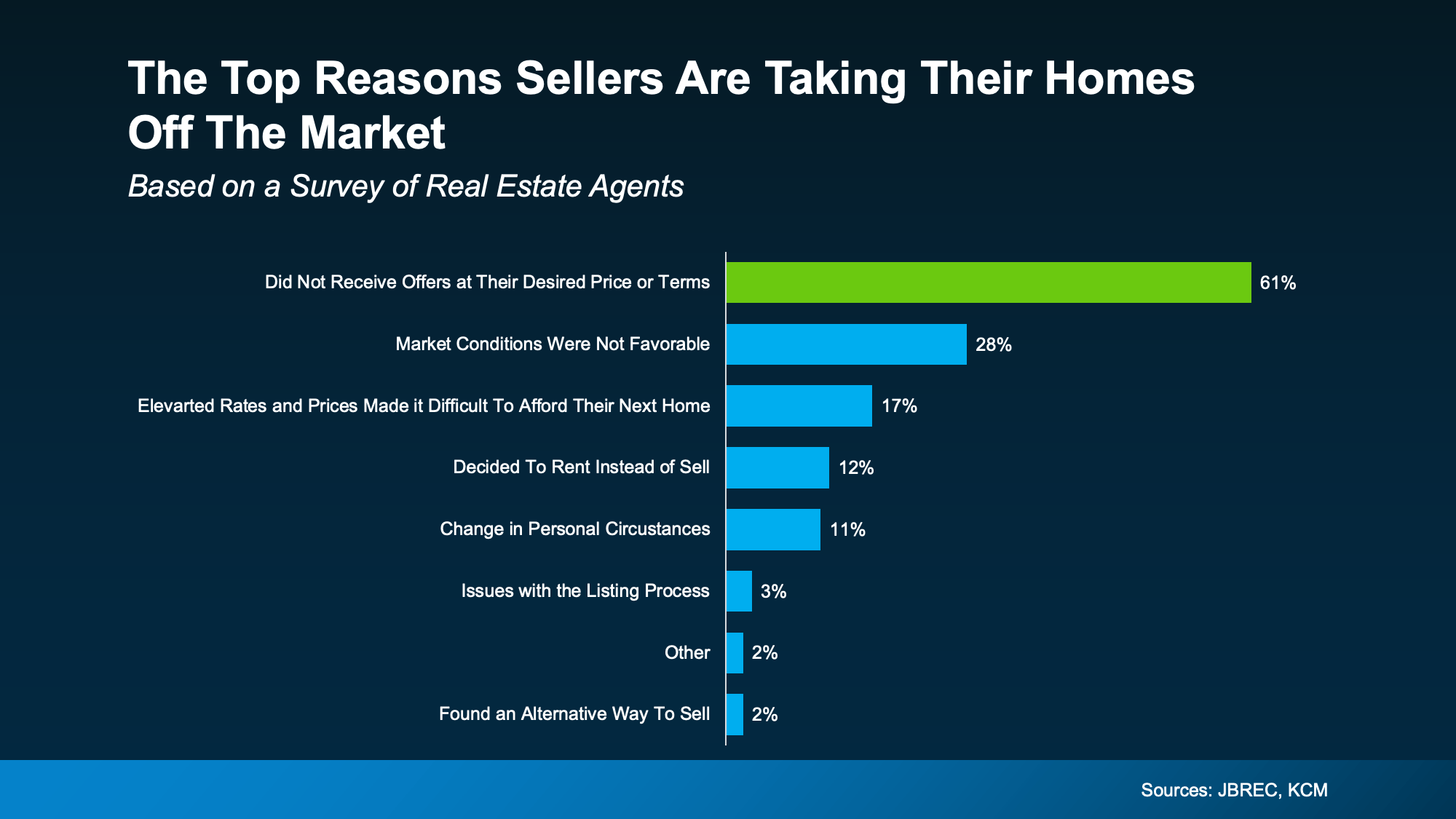

Don’t Let Unrealistic Pricing Cost You Your Move

These days, you’re going to want to get your price right when you get ready to sell your house. Honestly, it’s more important than ever. Why? While you may want to list high just to see what happens, that’s a plan that can easily backfire, and it’s going to cost you in today’s market.

And the risk isn’t just missing out on offers, it’s missing out on the move you needed to make in the first place.

The Real Pitfall of Overpricing

Many homeowners remember what their neighbor’s house sold for a few years ago, and they want to chase that same sky-high number. The problem is, that was a different market.

Today, there are more homes for sale. Buyers have more options to choose from. They don’t have to get into bidding wars where they offer way over asking just to compete. Now they can come in at, or even below, list price. And if you’re not open to that, they’ll move on. Lisa Sturtevant, Chief Economist at Bright MLS, explains:

“Buyers will have more leverage in many, but not all, markets. Sellers will need to adjust price expectations to reflect the transitioning market.”

But here’s the good news. You still have one big advantage as a seller. According to the Federal Housing Finance Agency (FHFA), home values went up by a staggering 54% over the last 5 years. So, even if you compromise just a little bit on your sale price today, odds are you’ll still come out way ahead.

The challenge? Most sellers aren’t thinking about it that way. They’re stuck on what a neighbor got months or years ago – and that’s a costly mistake.

Overpricing Can Stall Your Whole Move

Here’s what happens. A seller lists too high. Buyers stay away. No offers come in. The house sits. And suddenly, that seller is facing a tough decision. Do they cut the price? Stick it out? Or give up altogether?

Unfortunately, a late price cut may not be enough. Buyers often see that as a red flag that something’s wrong with the house. That’s why some sellers are opting to just pull their listing off the market entirely.

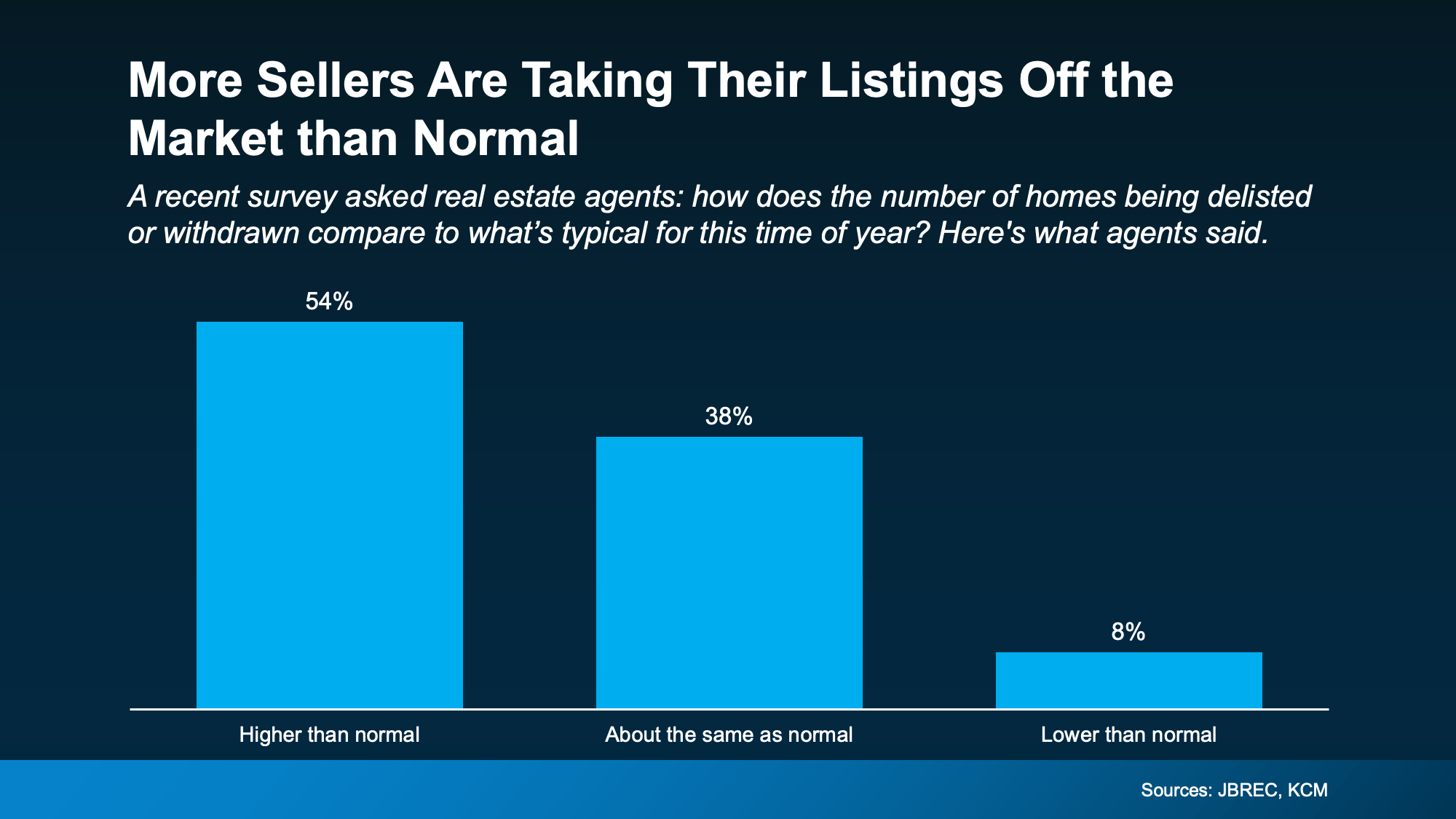

In a recent survey from John Burns Research and Consulting (JBREC) and Keeping Current Matters (KCM) over half of agents (54%) say there are more homes being taken off the market than usual.

And the top reasons for that? According to the agents, homeowners didn’t get any offers they felt were fair. The survey from JBREC and KCM explains it like this:

And the top reasons for that? According to the agents, homeowners didn’t get any offers they felt were fair. The survey from JBREC and KCM explains it like this:

“Sellers holding onto high price expectations is the leading reason they are delisting their homes.”

BrightMLS data backs this up:

BrightMLS data backs this up:

“. . . sellers are delisting after having their home on the market and finding they are not getting the price they hoped for.”

It’s more proof pricing too high does more than turn buyers away, it puts your whole move at risk. Because if no one looks at your home or makes an offer, how are you going to sell it?

The Secret To Making Your Move Happen

If you’re selling to relocate for a job, need more space for your growing family, or have to be closer to your relatives as they age, you can’t afford to get stuck. You need a pricing strategy that helps you move forward – and that starts with the right agent.

The sellers who are winning right now are the ones working with experienced local agents who know the current market and aren’t afraid to have honest conversations about price.

And it’s paying off. In the right price range and condition, homes are still selling fast, sometimes even with multiple offers.

Bottom Line

Pricing your house for today’s market isn’t just about getting it sold. It’s about making sure your move doesn’t stall before it starts.

Let’s talk through what buyers are really paying right now in our local area, and how to price your home to match.

Why Experts Say Mortgage Rates Should Ease Over the Next Year

You want mortgage rates to fall – and they’ve started to. But is it going to last? And how low will they go?

Experts say there’s room for rates to come down even more over the next year. And one of the leading indicators to watch is the 10-year treasury yield. Here’s why.

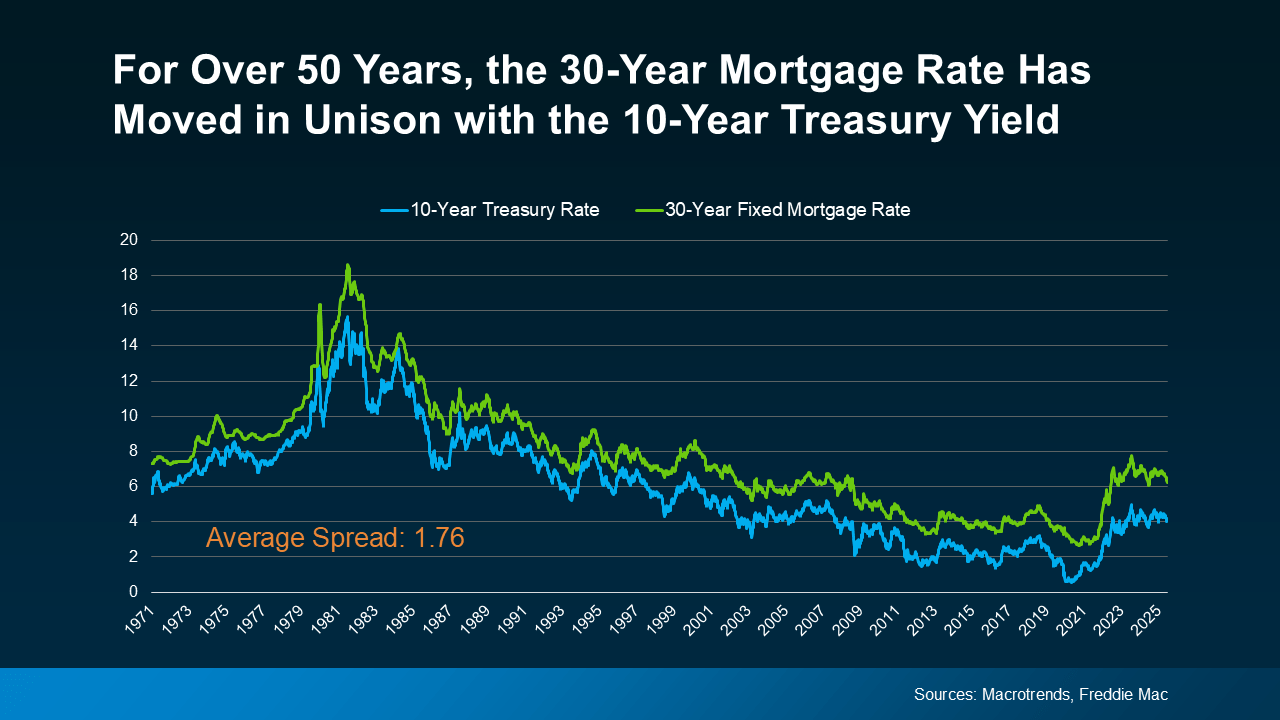

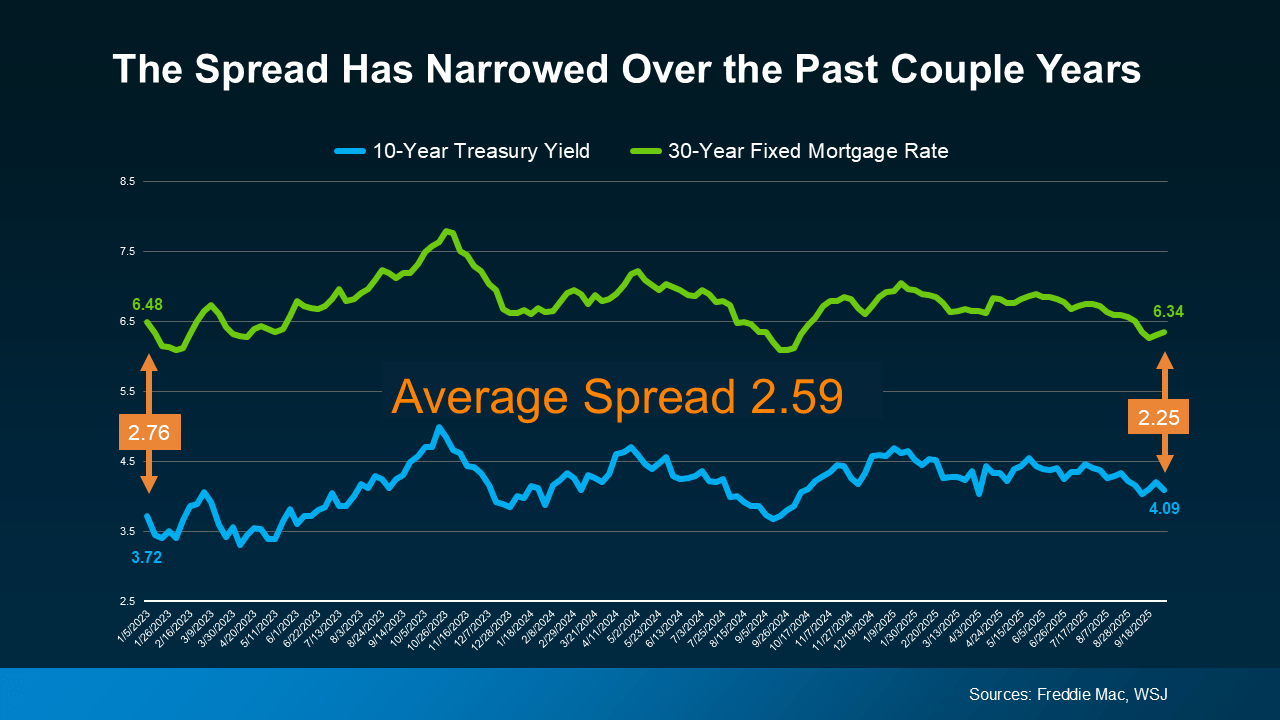

The Link Between Mortgage Rates and the 10-Year Treasury Yield

For over 50 years, the 30-year fixed mortgage rate has closely followed the movement of the 10-year treasury yield, which is a widely watched benchmark for long-term interest rates (see graph below):

When the treasury yield climbs, mortgage rates tend to follow. And when the yield falls, mortgage rates typically come down.

When the treasury yield climbs, mortgage rates tend to follow. And when the yield falls, mortgage rates typically come down.

It’s been a predictable pattern for over 50 years. So predictable, that there’s a number experts consider normal for the gap between the two. It’s known as the spread, and it usually averages about 1.76 percentage points, or what you sometimes hear as 176 basis points.

The Spread Is Shrinking

Over the past couple of years, though, that spread has been much wider than normal. Why? Think of the spread as a measure of fear in the market. When there’s lingering uncertainty in the economy, the gap widens beyond its usual norm. That’s one of the reasons why mortgage rates have been unusually high over the past few years.

But here’s a sign for optimism. Even though there’s still some lingering uncertainty related to the economy, that spread is starting to shrink as the path forward is becoming clearer (see graph below):

And that opens the door for mortgage rates to come down even more. As a recent article from Redfin explains:

And that opens the door for mortgage rates to come down even more. As a recent article from Redfin explains:

“A lower mortgage spread equals lower mortgage rates. If the spread continues to decline, mortgage rates could fall more than they already have.”

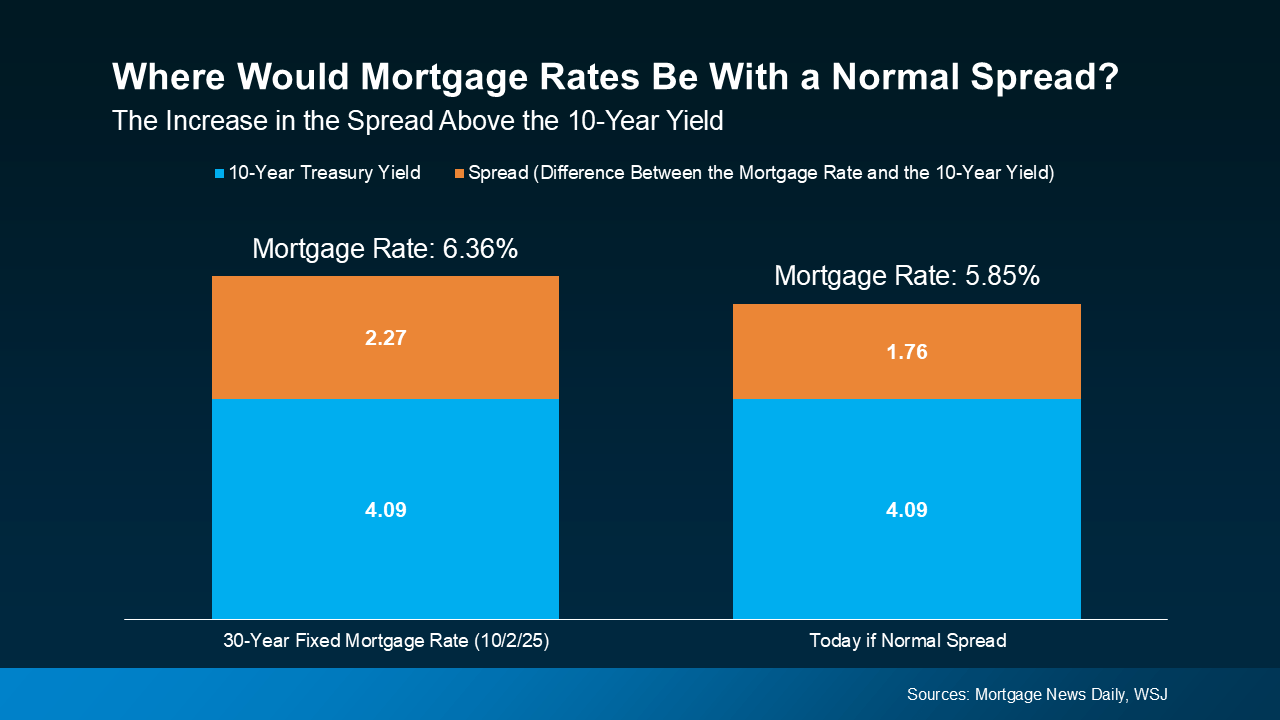

The 10-Year Treasury Yield Is Expected To Decline

It’s not just the spread, though. The 10-year treasury yield itself is also forecast to come down in the months ahead. So, when you combine a lower yield with a narrowing spread, you have two key forces potentially pushing mortgage rates down going into next year.

This long-term relationship is a big reason why you see experts currently projecting mortgage rates will ease, with a fringe possibility they’ll hit the upper 5s toward the end of next year.

Here’s how it works. Take the 10-year treasury yield, which is sitting at about 4.09% at the time this article is being written, and then add the average spread of 1.76%. From there, you’d expect mortgage rates to be around 5.85% (see graph below):

But remember, all of that can change as the economy shifts. And know for certain that there will be ups and downs along the way.

But remember, all of that can change as the economy shifts. And know for certain that there will be ups and downs along the way.

How these dynamics play out will depend on where the economy, the job market, inflation, and more go from here. But the 2026 outlook is currently expected to be a gradual mortgage rate decline. And as of now, things are starting to move in the right direction.

Bottom Line

Keeping up with all of these shifts can feel overwhelming. That’s why having an experienced agent or lender on your side matters. They’ll do the heavy lifting for you.

If you want real-time updates on mortgage rates, let’s connect so you have someone to keep you in the loop and help you plan your next move.

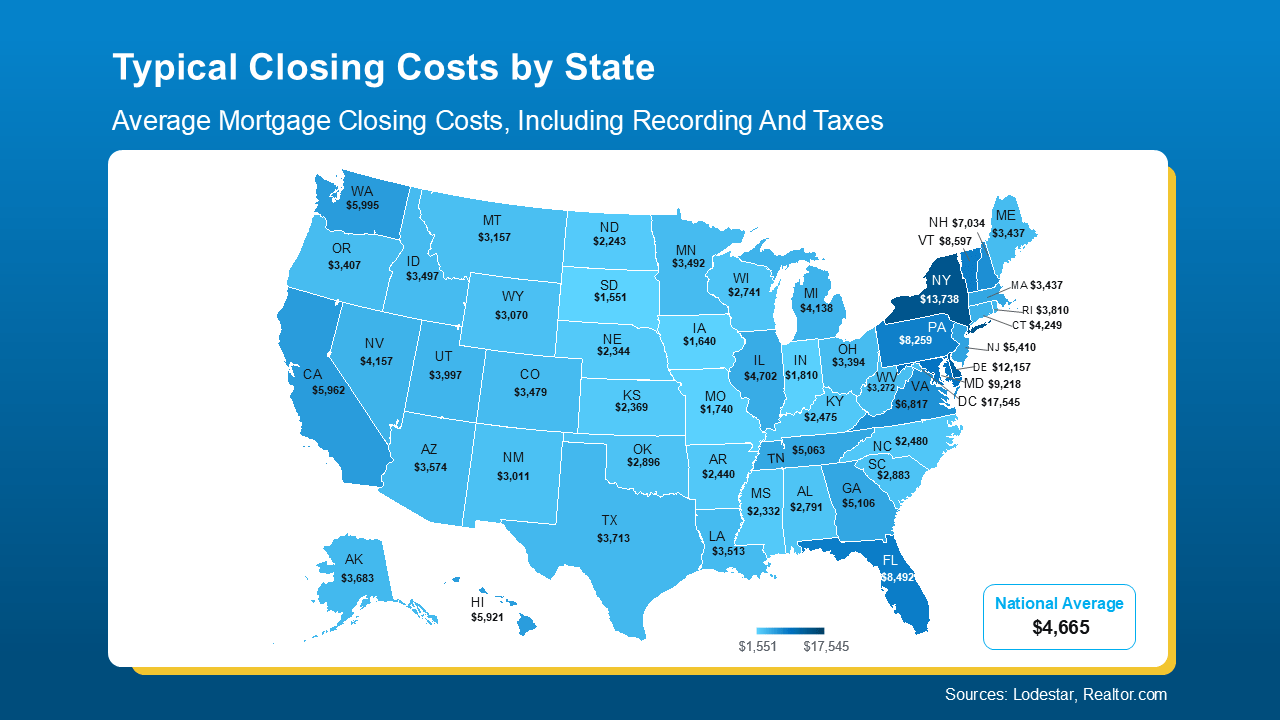

Closing Costs Unpacked

Closing Costs Unpacked: State-by-State Breakdowns for Today’s Buyers

If you’re planning to buy a home this year, there’s one expense you can’t afford to overlook: closing costs.

Almost every buyer knows they exist, but not that many know exactly what they cover, or how different they can be based on where you’re buying. So, let’s break them down.

What Are Closing Costs?

Your closing costs are the additional fees and payments you make when finalizing your home purchase. Every buyer has them. According to Freddie Mac, they typically include things like homeowner insurance and title insurance, as well as various fees for your:

- Loan application

- Credit report

- Loan origination

- Home appraisal

- Home inspection

- Property survey

- Attorney

National vs. Local: Why the Numbers Look So Different

When you search for information about closing costs online, you’ll often see a national range, usually 2% to 5% of the home’s purchase price. While that’s a useful starting point if you’re working on your homebuying budget, it doesn’t tell the whole story. In reality, your closing costs will also vary based on:

- Taxes and fees where you live (like transfer taxes and recording fees)

- Service costs for things like title and attorney work in your local area

While the home price is obviously going to matter, state laws, tax rates, and even the going costs for title and attorney services can change what you expect to pay. That’s why it’s important to talk to the pros ahead of time so you know what to budget for. It can put you in control before you even start shopping.

To give you a rough ballpark, here’s a state-by-state look at typical closing costs right now based on those factors for the median-priced home in each state (see map below):

As the map shows, in some states, typical closing costs are just roughly $1-3K. In a few places, they can be closer to $10-15K. That’s a big swing, especially if you’re buying your first home. And that’s why knowing what to expect matters.

As the map shows, in some states, typical closing costs are just roughly $1-3K. In a few places, they can be closer to $10-15K. That’s a big swing, especially if you’re buying your first home. And that’s why knowing what to expect matters.

If you want a real number to help with your budget, your best bet is to talk to a local agent and a lender. They can run the math for your price range, loan type, and exact location.

And just in case you’re looking at your state’s number and wondering if there’s any way to trim that bill, NerdWallet shares a few strategies that can help:

- Negotiate with the seller. Ask for concessions like a credit toward your closing costs.

- Shop around for homeowner’s insurance. Compare coverage and rates before you commit.

- Check for assistance programs. Some states, professions, and neighborhoods offer help. Your agent and lender can point you to what’s available locally.

Bottom Line

Closing costs are a key part of buying a home, but they can vary more than most people realize. Knowing your numbers (and how to potentially bring them down) can go a long way and help you feel confident about your purchase.

Let’s look at typical closing costs in our area and get you a personalized estimate, so you can craft your ideal budget.

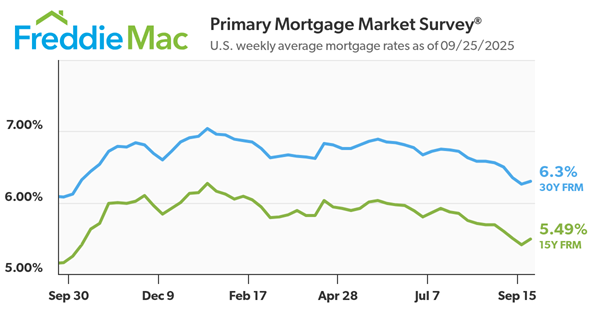

Inch by Inch

Freddie Mac results of its Primary Mortgage Market Survey® (PMMS®), show the 30-year fixed-rate mortgage (FRM) averaged 6.30%.

“Following several weeks of decline, mortgage rates inched up this week,” said Sam Khater, Freddie Mac’s Chief Economist. “Housing market activity continues to hold up with purchase and refinance applications increasing by 18% and 42%, respectively, compared to the same time last year.”

- The 30-year FRM averaged 6.30% as of September 25, 2025, up from last week when it averaged 6.26%. A year ago at this time, the 30-year FRM averaged 6.08%.

- The 15-year FRM averaged 5.49%, up from last week when it averaged 5.41%. A year ago at this time, the 15-year FRM averaged 5.16%.

The PMMS® is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20% down and have excellent credit.

Downsizing Without Debt

How More Homeowners Are Buying Their Next House in Cash

If you’ve been thinking about downsizing to lower your expenses, be closer to family, or just make life easier, here’s a trend worth paying attention to:

More homeowners are buying their next house outright, without taking on a new mortgage. And, if you’ve owned your home for a while, you may be able to do the same. No mortgage. No monthly housing payments.

A Record Share of Homeowners Are Mortgage-Free

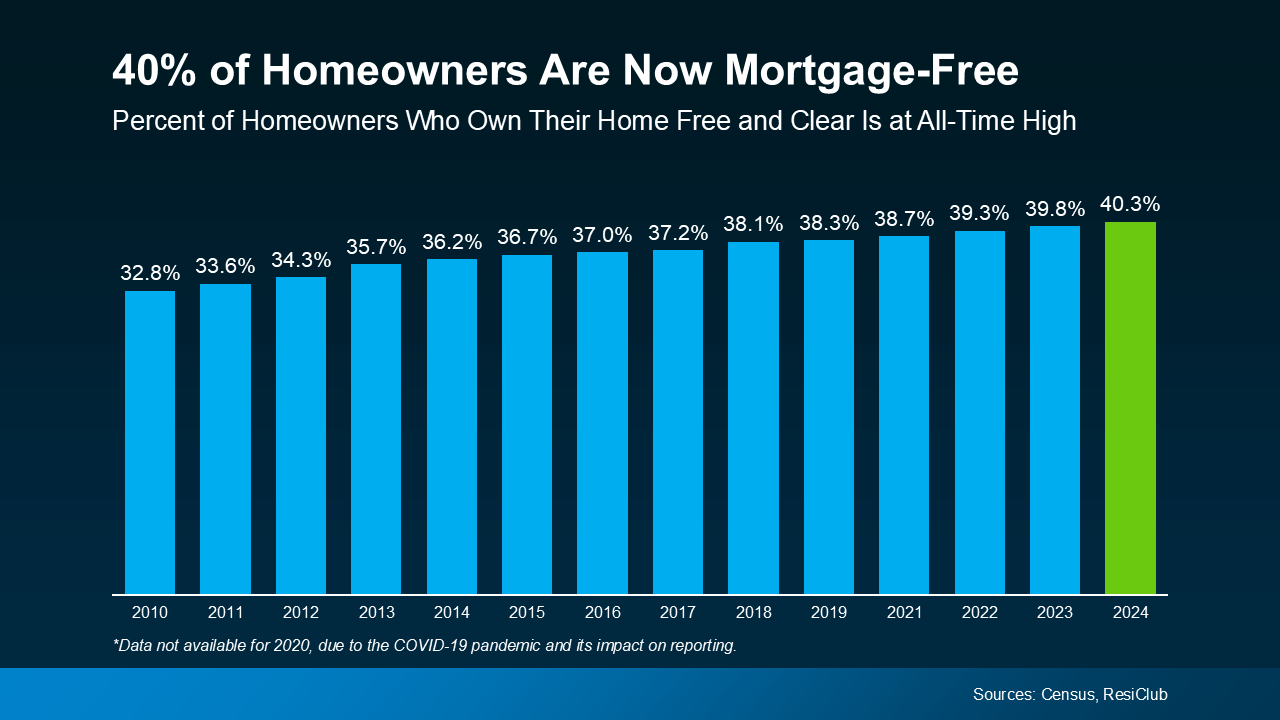

According to analysis from ResiClub of Census data, more than 40% of U.S. owner-occupied homes are mortgage-free – an all-time high for this data series. That means 4 in 10 homeowners own their homes free and clear (see graph below):

One big reason for this trend? Demographics. As Baby Boomers age and stay in their homes longer, many have had the time to fully pay off their mortgages. You might be in that group too and not even realize just how much buying power you now have. It’s time to change that.

One big reason for this trend? Demographics. As Baby Boomers age and stay in their homes longer, many have had the time to fully pay off their mortgages. You might be in that group too and not even realize just how much buying power you now have. It’s time to change that.

How Downsizers Are Turning Equity into Buying Power

As a homeowner, your equity is your biggest advantage in today’s market. If you’re mortgage-free (or close to it), it could give you the power to buy your next home in cash. That means you’d still have no mortgage payment in retirement, plus:

- Less financial stress as you age

- More cash flow, if you purchase a less expensive home

- And it would likely be a faster, simpler transaction

Here’s how it works. You’d sell your current house and use the proceeds to buy your next house in cash. And while that may sound like something you thought would never be possible for you, it’s more realistic than you may think.

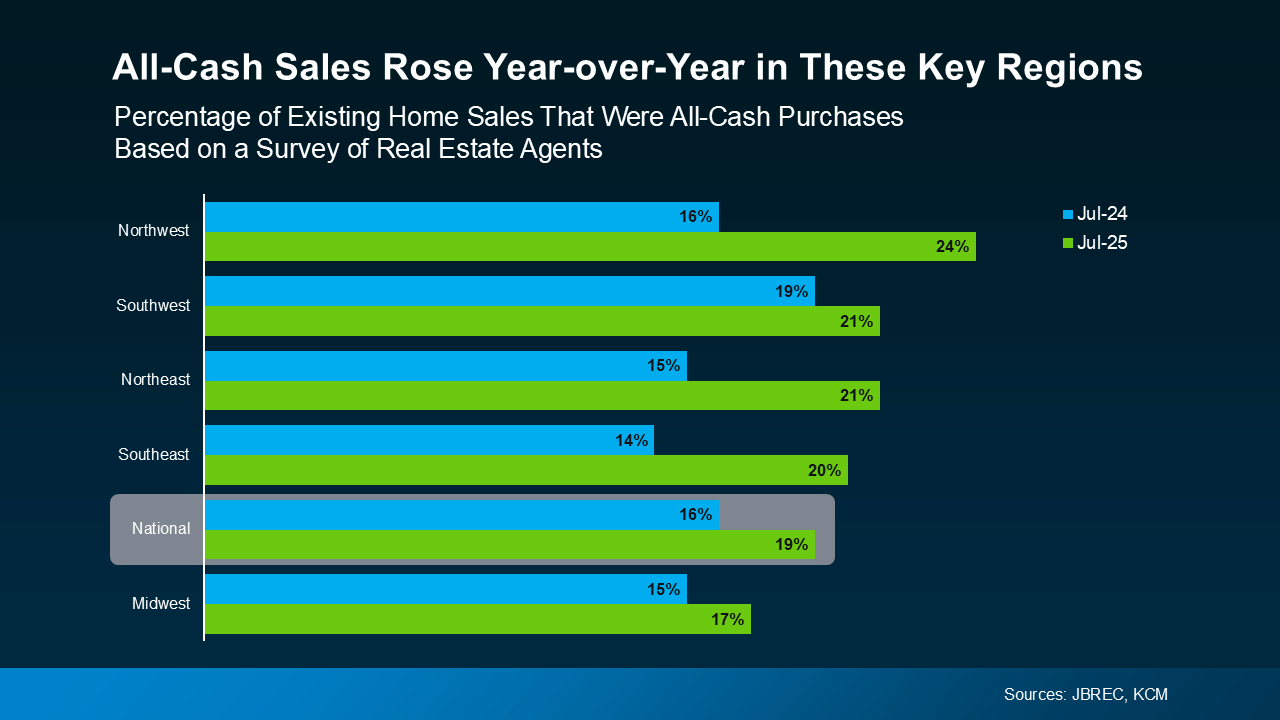

In the latest survey from John Burns Research and Consulting (JBREC) and Keeping Current Matters (KCM), agents reported the share of purchases with all-cash buyers is climbing nationally. And those agents are seeing increases in almost every region of the country (see graph below):

For Baby Boomers especially, buying in cash gives you more control over your next chapter. You could buy a smaller, less expensive home and have lower costs, less upkeep, and more flexibility to enjoy what matters most. All while staying debt and stress free.

For Baby Boomers especially, buying in cash gives you more control over your next chapter. You could buy a smaller, less expensive home and have lower costs, less upkeep, and more flexibility to enjoy what matters most. All while staying debt and stress free.

Because downsizing isn’t about downgrading your home. It’s about upgrading your quality of life. And that’s something worth exploring.

Bottom Line

You’ve worked hard for your home. Now it might be time for it to work hard for you.

Let’s talk about what your house is worth, and what it could unlock for you today. What would your ideal home look like if you were to downsize right now?

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link