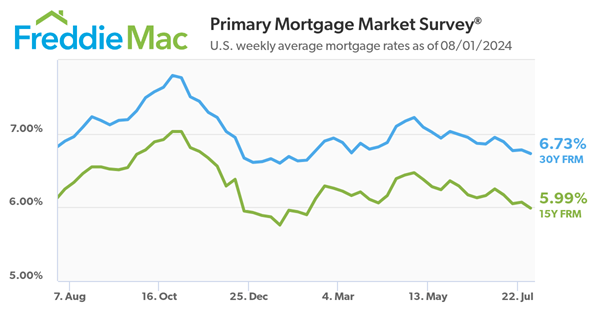

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®) for the week ending August 1, 2024, showing the 30-year fixed-rate mortgage (FRM) averaged 6.73 percent.

“Mortgage rates declined to their lowest level since early February,” said Sam Khater, Freddie Mac’s Chief Economist. “Expectations of a Fed rate cut coupled with signs of cooling inflation bode well for the market, but apprehension in consumer confidence may prevent an immediate uptick as affordability challenges remain top of mind. Despite this, a recent moderation in home price growth and increases in housing inventory are a welcoming sign for potential homebuyers.”

- The 30-year FRM averaged 6.73 percent as of August 1, 2024, down from last week when it averaged 6.78 percent. A year ago at this time, the 30-year FRM averaged 6.90 percent.

- The 15-year FRM averaged 5.99 percent, down from last week when it averaged 6.07 percent. A year ago at this time, the 15-year FRM averaged 6.25 percent.

The PMMS® is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20 percent down and have excellent credit.

For more information on mortgage interest rates, check with your mortgage lender. You can also check daily mortgage interest rate movements online at sites such as Mortgage News Daily.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link