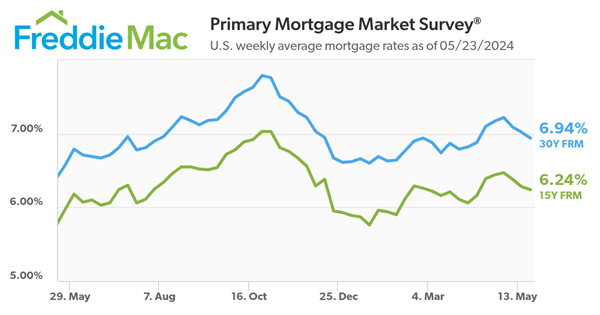

Buyers face challenges in any market – and today’s is no different. With higher mortgage rates and rising prices, plus the limited supply of homes for sale, there’s a lot to consider.

But, there’s one way to avoid getting tripped up – and that’s leaning on a real estate agent for the best possible advice. An expert’s insights will help you avoid some of the most common mistakes homebuyers are making right now.

Putting Off Pre-approval

As part of the homebuying process, a lender will look at your finances to figure out what they’re willing to loan you for your mortgage. This gives you a good idea of what you can borrow so you can really wrap your head around the financial side of things before you start looking at homes. While house hunting can be a lot more fun than talking about finances, you don’t want to do this out of order. Make sure you get your pre-approval first. As CNET explains:

“If you wait to get preapproved until the last minute, you might be scrambling to contact a lender and miss the opportunity to put a bid on a home.”

Holding Out for Perfection

While you may have a long list of must-haves and nice-to-haves, you need to be realistic about your home search. Even though your ideal state is you find a home that checks every box, you may need to be willing to compromise – especially since inventory is still low. Plus, a home that has everything you want may be too pricey. As Investopedia puts it:

“When you expect to find the perfect home, you could prolong the homebuying process by holding out for something better. Or you could end up paying more for a home just because it meets all your needs.”

Instead, look for something that has most of your must-haves and good bones where you can add anything else you may need down the line.

Buying More House Than You Can Afford

With today’s mortgage rates and home prices, there’s no arguing it’s expensive to buy a home. And while it may be tempting to stretch your finances a bit further than you’re comfortable with to make sure you get the house, you want to avoid overextending your budget. Make sure you talk to your agent about how changing mortgage rates impact your monthly payment. Bankrate offers this advice:

“Focus on what monthly payment you can afford rather than fixating on the maximum loan amount you qualify for. Just because you can qualify for a $300,000 loan doesn’t mean you can comfortably handle the monthly payments that come with it along with your other financial obligations. Every borrower’s case is different, so factor in your whole financial profile when determining how much house you can afford.”

Not Working with a Local Real Estate Agent

This last one may be the most important of all. Buying a home is a process that involves a lot of steps, paperwork, negotiation, and more. Rather than take all of this on yourself, it’s a good idea to have a pro working with you. The right agent will reduce your stress and help the process go smoothly. As CNET explains:

“Attempting to buy a home without a real estate agent makes the process more arduous than it needs to be. A real estate agent can give you professional legal guidance, market expertise and support, which will save you time, money and stress. They can also increase your chances of finding the right home so you don’t have to spend hours scouring the internet for listings.”

Bottom Line

Mistakes can cost you time, frustration, and money. If you want to buy a home in today’s market, let’s connect so you have a pro on your side who can help you avoid these missteps.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link