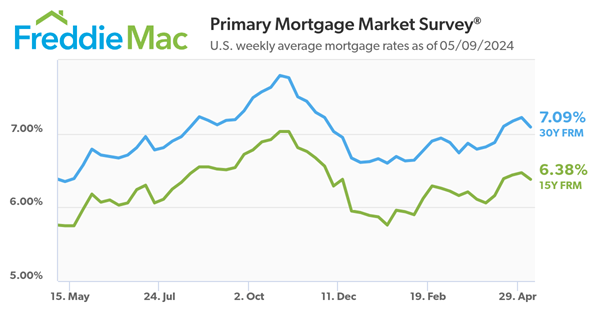

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing the 30-year fixed-rate mortgage (FRM) averaged 7.09 percent.

“After a five week climb, mortgage rates ticked down following a weaker than expected jobs report,” said Sam Khater, Freddie Mac’s Chief Economist. “An environment where rates continue to hover above seven percent impacts both sellers and buyers. Many potential sellers remain hesitant to list their home and part with lower mortgage rates from years prior, adversely impacting supply and keeping house prices elevated. These elevated house prices add to the overall affordability challenges that potential buyers face in this high-rate environment.”

- The 30-year FRM averaged 7.09 percent as of May 9, 2024, down from last week when it averaged 7.22 percent. A year ago at this time, the 30-year FRM averaged 6.35 percent.

- The 15-year FRM averaged 6.38 percent, down from last week when it averaged 6.47 percent. A year ago at this time, the 15-year FRM averaged 5.75 percent.

The PMMS® is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20 percent down and have excellent credit.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link