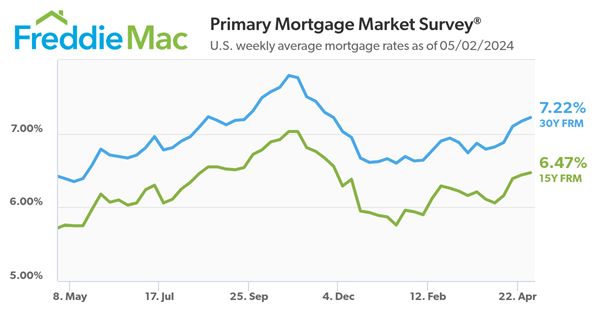

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing the 30-year fixed-rate mortgage (FRM) averaged 7.22 percent for the week ending 05/02/2024.

“The 30-year fixed-rate mortgage increased for the fifth consecutive week as we enter the heart of Spring Homebuying Season,” said Sam Khater, Freddie Mac’s Chief Economist. “On average, more than one-third of home sales for the entire year occur between March and June. With two months left of this historically busy period, potential homebuyers will likely not see relief from rising rates anytime soon. However, many seem to have acclimated to these higher rates, as demonstrated by the recently released pending home sales data coming in at the highest level in a year.”

- The 30-year FRM averaged 7.22 percent as of May 2, 2024, up from last week when it averaged 7.17 percent. A year ago at this time, the 30-year FRM averaged 6.39 percent.

- The 15-year FRM averaged 6.47 percent, up from last week when it averaged 6.44 percent. A year ago at this time, the 15-year FRM averaged 5.76 percent.

The PMMS® is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20 percent down and have excellent credit.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link