Mortgage interest rates took break this week from their upward ascent.

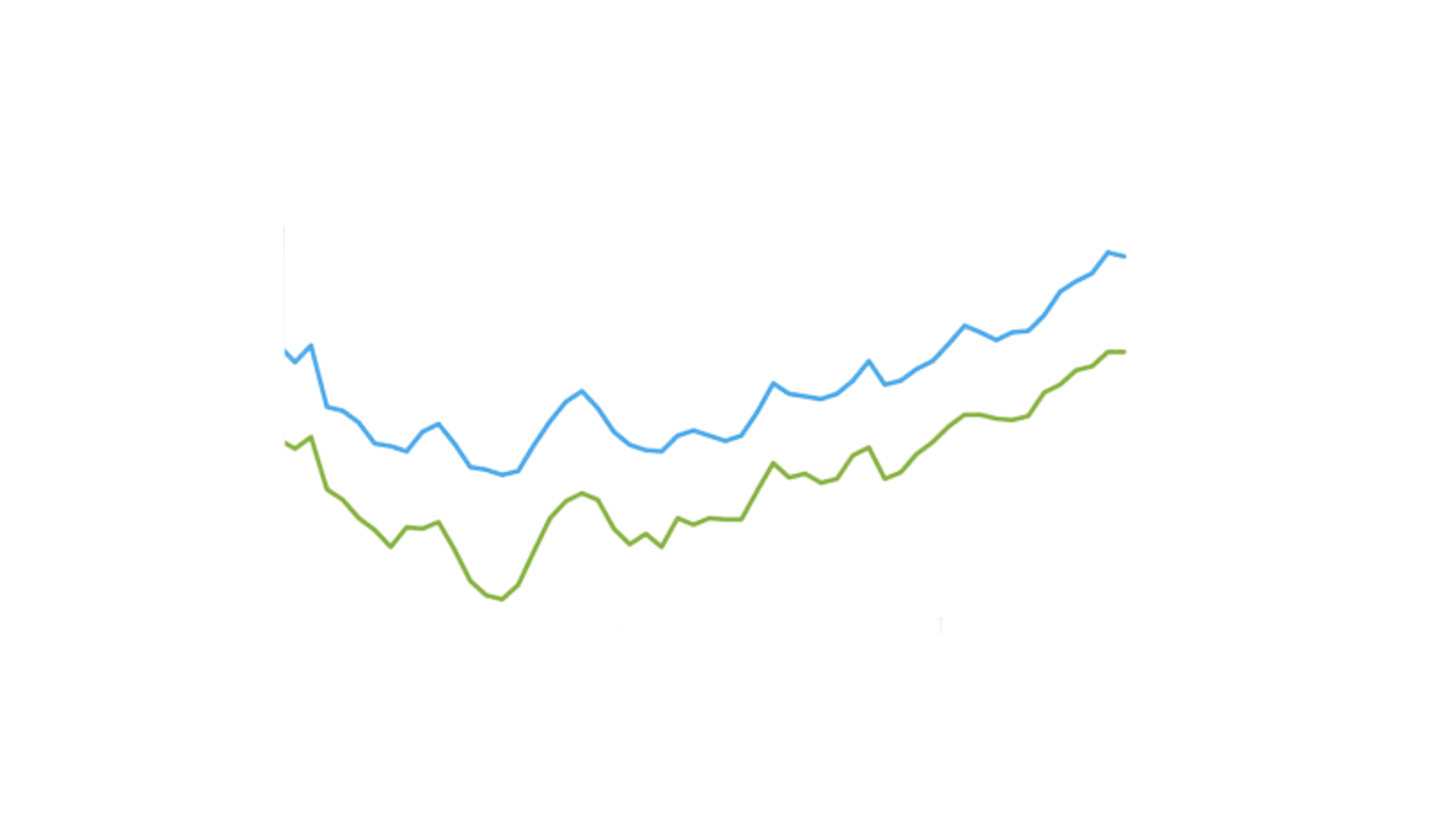

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing the 30-year fixed-rate mortgage (FRM) averaged 7.76 percent.

“The 30-year fixed-rate mortgage paused its multi-week climb but continues to hover under eight percent,” said Sam Khater, Freddie Mac’s Chief Economist. “The Federal Reserve again decided not to raise interest rates but have not ruled out a hike before year-end. Coupled with geopolitical uncertainty, this ambiguity around monetary policy will likely have an impact on the overall economic landscape and may continue to stall improvements in the housing market.”

- 30-year fixed-rate mortgage averaged 7.76 percent as of November 2, 2023, down from last week when it averaged 7.79 percent. A year ago at this time, the 30-year FRM averaged 6.95 percent.

- 15-year fixed-rate mortgage averaged 7.03 percent, unchanged from last week. A year ago at this time, the 15-year FRM averaged 6.29 percent.

The PMMS® is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20 percent down and have excellent credit.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link