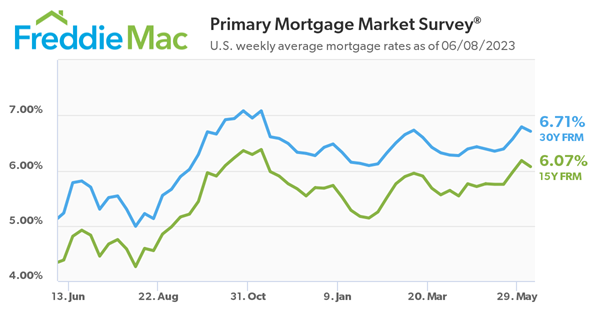

Freddie Mac today released the results of its Primary Mortgage Market Survey, showing the 30-year fixed-rate mortgage (FRM) averaged 6.71 percent.

“Mortgage rates decreased after a three-week climb,” said Sam Khater, Freddie Mac’s Chief Economist. “While elevated rates and other affordability challenges remain, inventory continues to be the biggest obstacle for prospective homebuyers.”

News Facts

- 30-year fixed-rate mortgage averaged 6.71 percent as of June 8, 2023, down from last week when it averaged 6.79 percent. A year ago at this time, the 30-year FRM averaged 5.23 percent.

- 15-year fixed-rate mortgage averaged 6.07 percent, down from last week when it averaged 6.18 percent. A year ago at this time, the 15-year FRM averaged 4.38 percent.

The PMMS is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20 percent down and have excellent credit.

For more information on daily interest rate movements you can check with your mortgage lender. You may also find daily mortgage interest change information online at sites such as Mortgage News Daily.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link