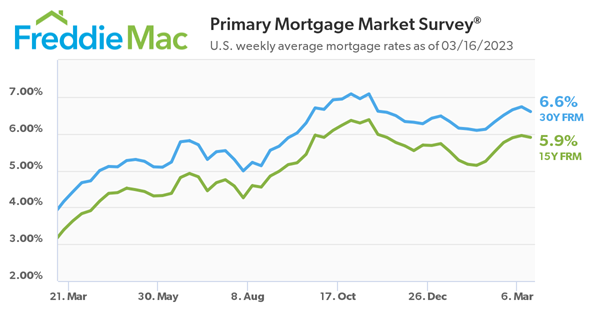

Freddie Mac released its Primary Mortgage Market Survey® (PMMS®) today March 16, 2023, revealing that the 30-year fixed-rate mortgage averaged 6.60 percent, down from 6.73 percent the previous week. The 15-year FRM also decreased from 5.95 percent to 5.90 percent. However, both rates are significantly higher than a year ago when the 30-year FRM averaged 4.16 percent and the 15-year FRM averaged 3.39 percent in March 2022. The decline in mortgage rates was attributed to turbulence in financial markets, which is putting downward pressure on rates. Freddie Mac’s Chief Economist said homebuyers should shop for multiple quotes from lenders to potentially save between $600 to $1,200 annually. The PMMS® focuses on conventional, conforming, fully amortizing home purchase loans for borrowers with excellent credit and a 20 percent down payment, so rates for other types of mortgages may differ.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link