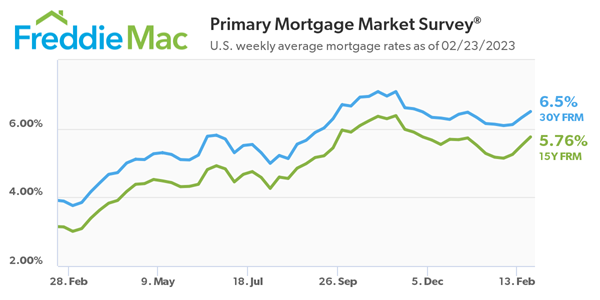

Freddie Mac (OTCQB: FMCC) today released the results of its Primary Mortgage Market Survey® (PMMS®)for the week ending 02/23/2023, showing the 30-year fixed-rate mortgage (FRM) averaged 6.50 percent.

“The economy continues to show strength, and interest rates are repricing to account for the stronger than expected growth, tight labor market and the threat of sticky inflation,” said Sam Khater, Freddie Mac’s Chief Economist. “Our research shows that rate dispersion increases as mortgage rates trend up. This means homebuyers can potentially save $600 to $1,200 annually by taking the time to shop among lenders to find a better rate.”

- 30-year fixed-rate mortgage averaged 6.50 percent as of February 23, 2023, up from last week when it averaged 6.32 percent. A year ago at this time, the 30-year FRM averaged 3.89 percent.

- 15-year fixed-rate mortgage averaged 5.76 percent, up from last week when it averaged 5.51 percent. A year ago at this time, the 15-year FRM averaged 3.14 percent.

The PMMS® is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20 percent down and have excellent credit.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link