If you’ve been watching the news or reading the newspaper you can’t miss all of the talk about a possible recession. The Federal Reserve is trying to engineer a so-called soft landing for the economy as it raises interest rates to fight inflation. Fighting inflation is one of the Federal Reserves’ primary mandates.

According to a recent survey, more and more Americans are concerned about a possible recession. Those concerns were validated when the Federal Reserve met and confirmed they were strongly committed to bringing down inflation. And, in order to do so, they’d use their tools and influence to slow down the economy.

All of this brings up many fears and questions around how it might affect our lives, our jobs, and business overall. And one concern many Americans have is: how will this affect the housing market? We know how economic slowdowns have impacted home prices in the past, but how could this next slowdown affect real estate and the cost of financing a home?

According to Mortgage Specialists:

“Throughout history, during a recessionary period, interest rates go up at the beginning of the recession. But in order to come out of a recession, interest rates are lowered to stimulate the economy moving forward.”

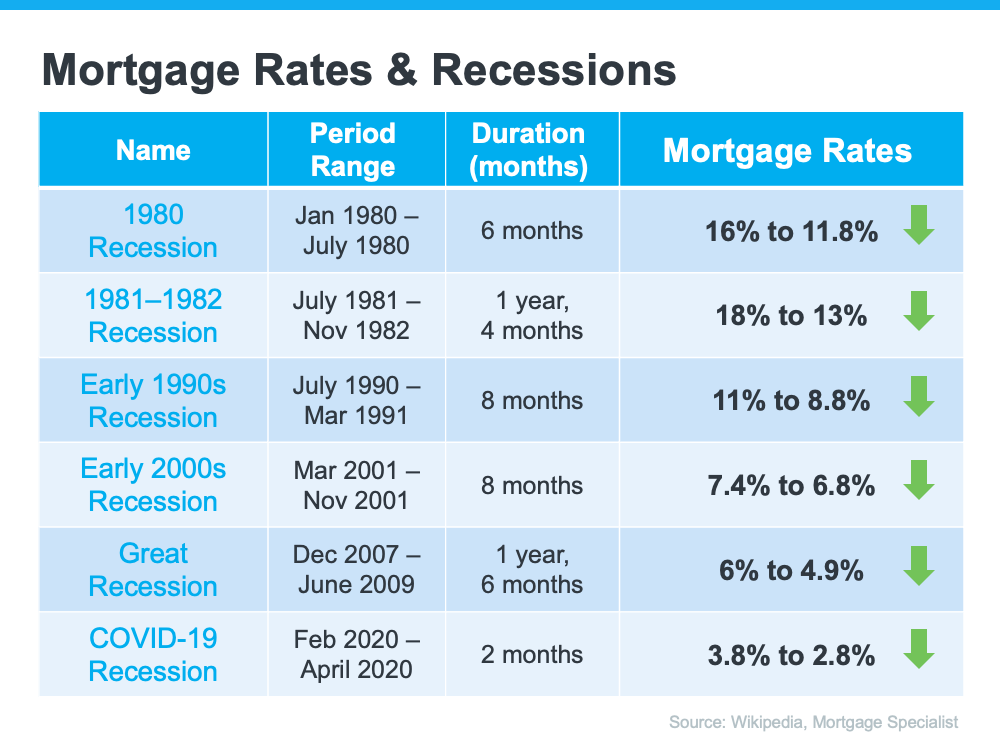

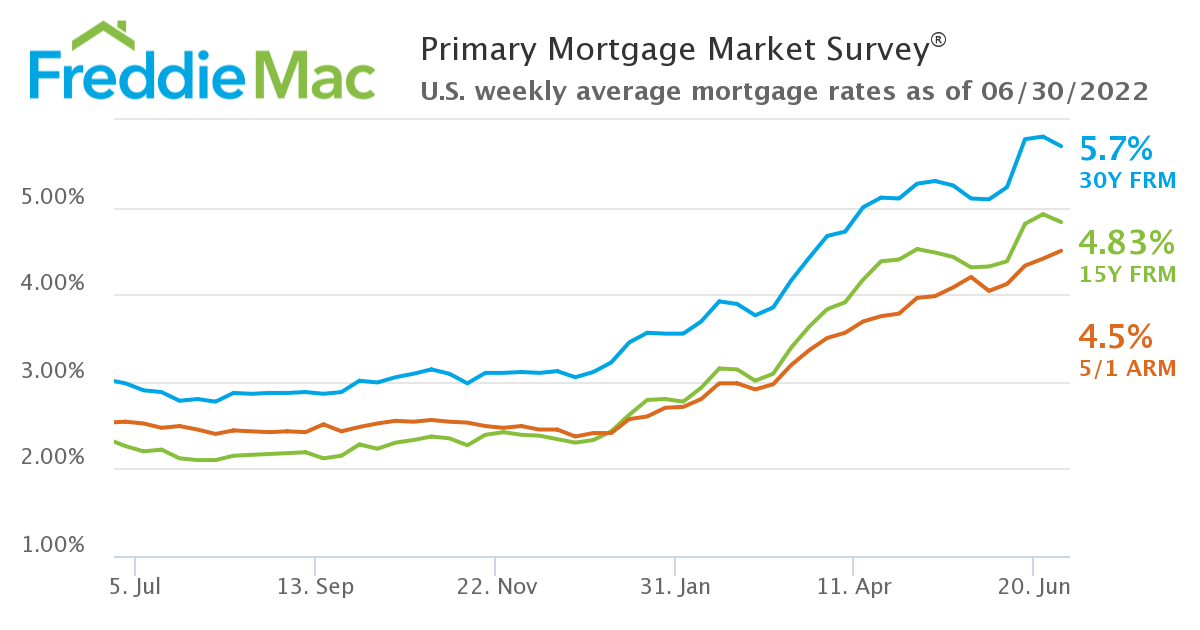

Here’s the data to back that up. If you look back at each recession going all the way to the early 1980s, here’s what happened to mortgage rates during those times (see chart below):

As the chart shows, historically, each time the economy slowed down, mortgage rates decreased. Fortune.com helps explain the trend like this:

“Over the past five recessions, mortgage rates have fallen an average of 1.8 percentage points from the peak seen during the recession to the trough. And in many cases, they continued to fall after the fact as it takes some time to turn things around even when the recession is technically over.”

And while history doesn’t always repeat itself, we can learn from it. While an economic slowdown needs to happen to help taper inflation, it hasn’t always been a bad thing for the housing market. Typically, it has meant that the cost to finance a home has gone down, and that’s a good thing.

Bottom Line

Concerns of a recession are rising. As the economy slows down, history tells us this would likely mean lower mortgage rates for those looking to refinance or buy a home. While no one knows exactly what the future holds, you can make the right decision for you by working with a trusted real estate professional to get expert advice on what’s happening in the housing market and what that means for your homeownership goals.

This article provided by Keeping Current Matters.

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Keeping Current Matters, Inc. does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Keeping Current Matters, Inc. will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link