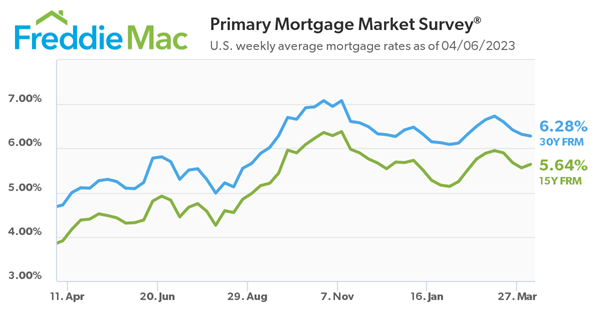

30-year fixed Mortgage Rate Trends Down to 6.28%

Freddie Mac, the government-sponsored mortgage giant, has released the results of its Primary Mortgage Market Survey® (PMMS®), revealing that the 30-year fixed-rate mortgage (FRM) averaged 6.28 percent as of April 6, 2023. This marks a decline from last week when it averaged 6.32 percent, and a significant increase from a year ago when the 30-year FRM averaged 4.72 percent.

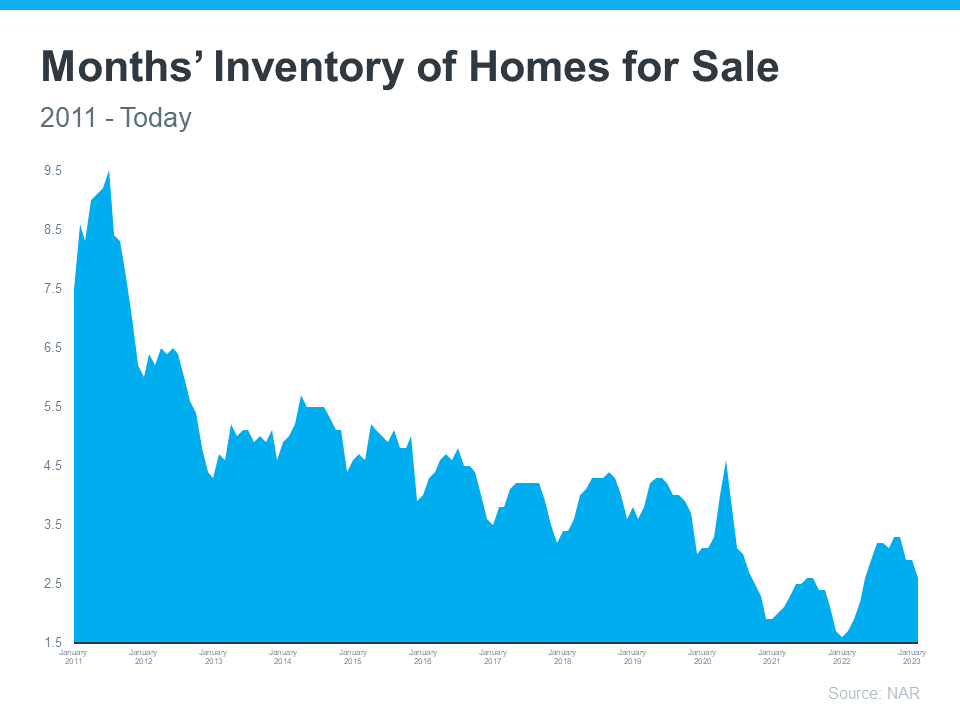

Sam Khater, Freddie Mac’s Chief Economist, noted that mortgage rates are continuing to trend down as the traditional spring homebuying season begins. However, he also highlighted the challenges faced by potential homebuyers, particularly first-time homebuyers, due to the low inventory of homes for sale in the market.

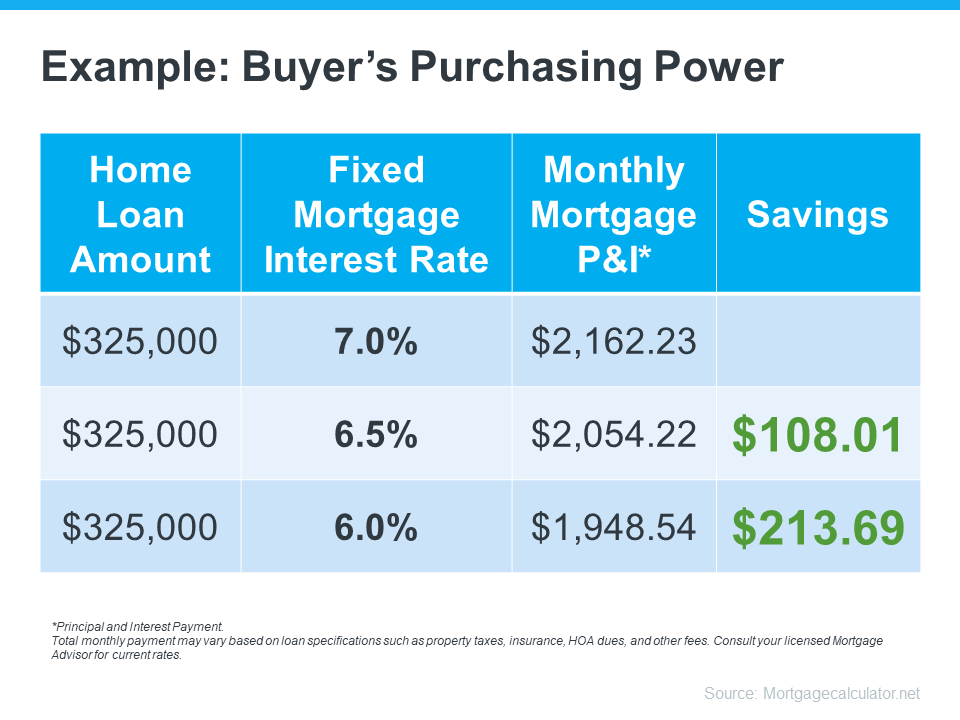

According to Lawrence Yun, Chief Economist of the National Association of Realtors (NAR), the decline in mortgage rates over the past four weeks is a positive development for homebuyers. Compared to the recent peak of 7% average rate, the current rate of 6.28% can save a homebuyer $140 per month on a $300,000 loan.

Yun also pointed out that the fallout from regional bank collapses has led to tightening lending conditions in some areas, but residential mortgages, including VA, FHA, and conforming mortgages, continue to have government guarantees, which ensure a steady appetite for these loans.

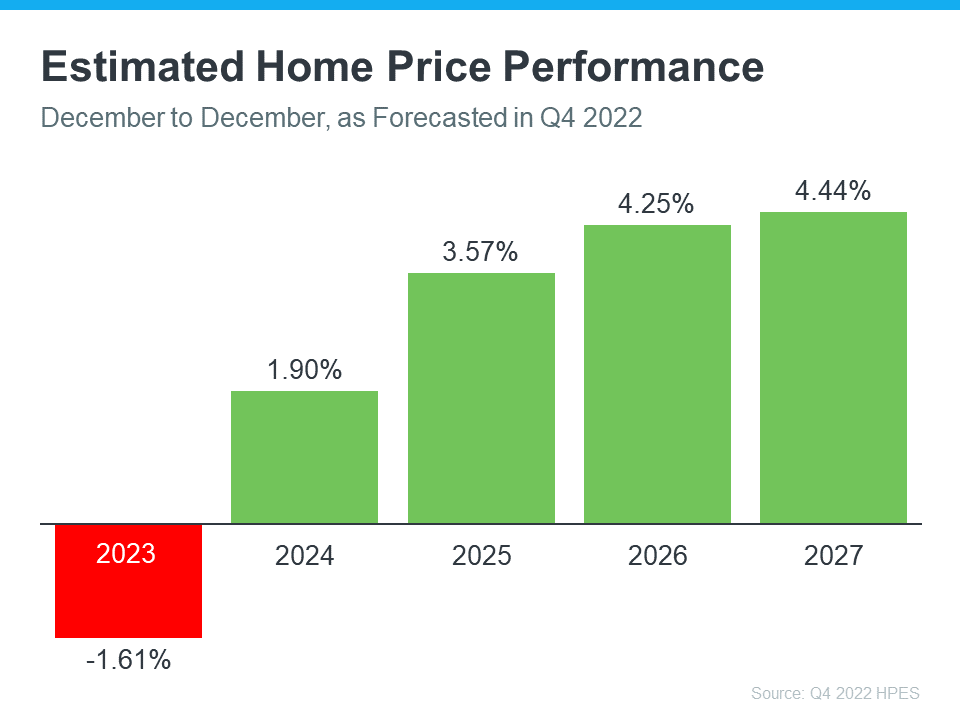

The longer-term prospect on mortgage rates is also positive, with the possibility of rates going under 6% by the end of the year. Yun attributed this to the steady supply of new apartments hitting the market, which will limit rent growth and overall consumer price inflation, leading to the Federal Reserve potentially stopping its tightening policy. Lower rates are expected to attract more homebuyers, but it is crucial to ensure an increase in housing supply to meet the recovering demand.

Overall, the declining trend in mortgage rates is good news for potential homebuyers, but challenges such as low inventory and tightening lending conditions remain. It will be important to monitor how these factors evolve in the coming months and their impact on the housing market.

Should You Sell Your House Now?

Here’s Two Reasons You Should Sell Your House.

Wondering if you should sell your house this year? As you make your decision, think about what’s motivating you to consider moving. A recent survey from realtor.com asked why homeowners are thinking about selling their houses this year. Here are the top two reasons (see graphic below):

Let’s break those reasons down and explore how they might resonate with you.

1. I Want To Take Advantage of the Current Market and Make a Profit

When you decide to sell your house, how much you’ll make from the sale will likely be top of mind. So, here’s some good news: according to the latest data, the average seller can expect a strong return on their investment when they make a move. ATTOM explains:

“The $112,000 profit on median-priced home sales in 2022 represented a 51.4% return on investment compared to the original purchase price, up from 44.6% last year and from 32.8% in 2020.”

Even though home prices have declined slightly in some markets, they’re still much higher overall than they were just a few years ago. To understand what’s happening with home prices in your area and the current value of your house, work with a local real estate professional. They can give you the best advice on how much you could gain if you sell this year.

2. My Home No Longer Meets My Needs

The average person has been in their house for ten years. That’s a long time when you think about how much may have changed in your life since you moved in. And typically, those changes have a direct impact on what you need in a home. Whether it’s more (or less) space, different features, or a location closer to your work or loved ones, your current house may no longer check all the boxes of what feels like home to you. If that’s the case, it could be time to work with a real estate agent to find a better fit.

Bottom Line

If you’re thinking about selling your house, there’s probably a good reason for it. Let’s connect so you can make a move that’ll help you accomplish your goals this year.

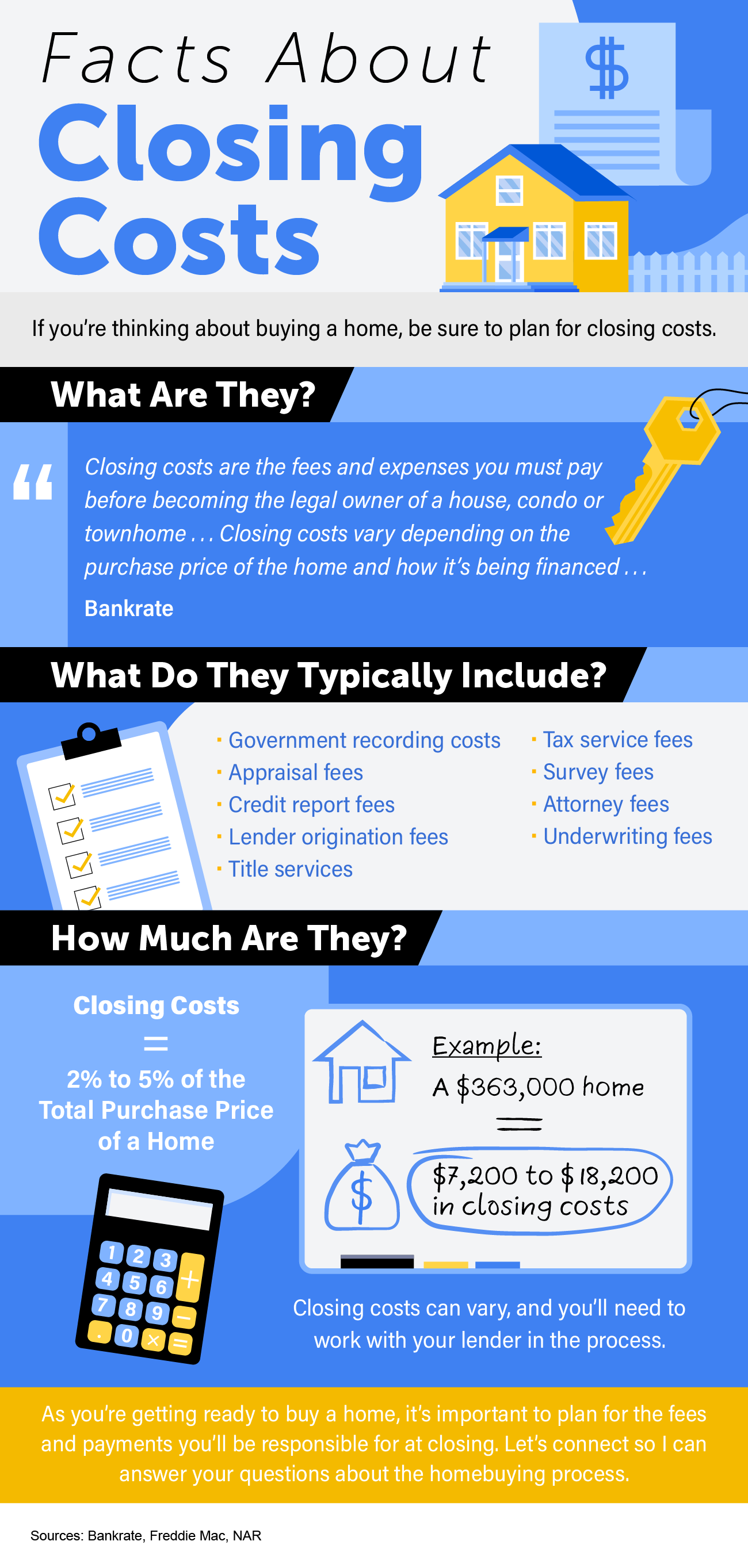

Facts You Should Know About Closing Costs

Some Highlights

- If you’re thinking about buying a home, be sure to plan for closing costs.

- Closing costs are typically 2% to 5% of the total purchase price of a home, and they can include things like government recording costs, appraisal fees, and more.

- Let’s connect so I can answer your questions about the homebuying process.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link