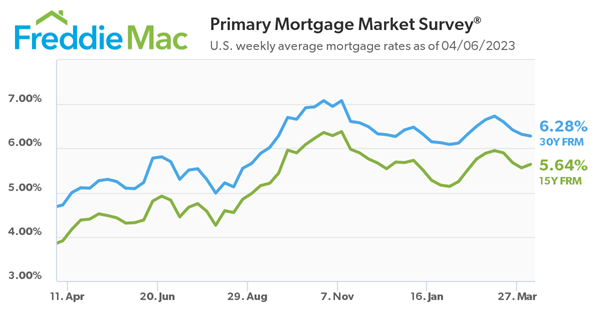

Freddie Mac, the government-sponsored mortgage giant, has released the results of its Primary Mortgage Market Survey® (PMMS®), revealing that the 30-year fixed-rate mortgage (FRM) averaged 6.28 percent as of April 6, 2023. This marks a decline from last week when it averaged 6.32 percent, and a significant increase from a year ago when the 30-year FRM averaged 4.72 percent.

Sam Khater, Freddie Mac’s Chief Economist, noted that mortgage rates are continuing to trend down as the traditional spring homebuying season begins. However, he also highlighted the challenges faced by potential homebuyers, particularly first-time homebuyers, due to the low inventory of homes for sale in the market.

According to Lawrence Yun, Chief Economist of the National Association of Realtors (NAR), the decline in mortgage rates over the past four weeks is a positive development for homebuyers. Compared to the recent peak of 7% average rate, the current rate of 6.28% can save a homebuyer $140 per month on a $300,000 loan.

Yun also pointed out that the fallout from regional bank collapses has led to tightening lending conditions in some areas, but residential mortgages, including VA, FHA, and conforming mortgages, continue to have government guarantees, which ensure a steady appetite for these loans.

The longer-term prospect on mortgage rates is also positive, with the possibility of rates going under 6% by the end of the year. Yun attributed this to the steady supply of new apartments hitting the market, which will limit rent growth and overall consumer price inflation, leading to the Federal Reserve potentially stopping its tightening policy. Lower rates are expected to attract more homebuyers, but it is crucial to ensure an increase in housing supply to meet the recovering demand.

Overall, the declining trend in mortgage rates is good news for potential homebuyers, but challenges such as low inventory and tightening lending conditions remain. It will be important to monitor how these factors evolve in the coming months and their impact on the housing market.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link