Momentum is quietly building in the housing market. New data from NerdWallet shows more Americans are starting to think about buying a home again. Last year, 15% of respondents said they planned to buy a home in the next 12 months. This year, that number rose to 17%.

That 2% increase might not sound like a big jump, but in a market where buyer demand has been cooling for the past few years, it’s a sign things are starting to shift. More people are feeling ready (or at least closer to ready) to take the leap and buy a home in 2026.

And if you’re in that camp and buying a home is on your goal sheet this year, this is your nudge to connect with a local agent and a trusted lender to start laying the groundwork now.

Planning To Move in Early 2026? Start with These 4 Steps

If you’re eager to get the ball rolling right away, here’s what to tackle first:

- Get pre-approved. A pre-approval gives you a real understanding of your buying power and what your payment could be at today’s rates. But keep in mind, Experian says most pre-approvals are only good for 30-90 days, so this step makes the most sense as you’re ready to get serious.

- Run the numbers. Look closely at all your expenses to come up with your budget. Consider what you’re spending on other bills and what your monthly mortgage payment would be once you buy. That way you go in with open eyes and you don’t stretch too far.

- Define your non-negotiables. Once you know the numbers work, figure out your must-haves. This includes your desired location, commute, layout, school district, lifestyle needs, etc. Getting clear on these now makes decisions easier once you start looking at homes.

- Choose your agent early. Look at reviews online and talk to multiple agents to find one you trust that you also click with. The right agent does more than show homes. They help you understand pricing, competition, timing, and strategy before you ever write an offer.

Thinking about Buying Later in the Year? This Is Still Your Window To Prepare

Even if buying feels like a late-2026 goal, this moment still matters. The buyers who feel the most confident later are usually the ones who quietly prepared earlier.

That doesn’t mean big financial commitments or major lifestyle changes. It just means setting yourself up so you’re ready when the timing is right. Here are a few low-stress ways to do that:

- Work on your credit. While you don’t need to have perfect credit to buy a home, your score can have an impact on your loan terms and even your mortgage rate. So, working to bring up your score has its perks. Paying down debt now and making payments on time can help bring your score up.

- Automate your savings. If you have to remember to transfer money into your homebuying savings manually, you may forget to do it. So, you may want to set up automatic transfers to drive consistency and remove the temptation to spend the money elsewhere.

- Lean into your side hustles: Do you have a gig you do (or have done before) to net some extra cash? Taking on part-time work, freelance jobs, or picking up a side hustle can help give your savings a boost.

- Put any unexpected cash to good use: If you get any sudden windfalls, like a tax refund, bonus, inheritance, or cash gift from family, put it toward your house fund. You’ll thank yourself later.

The common thread here? The right prep work makes a difference.

Bottom Line

If buying a home in 2026 is on your radar, let’s start the conversation today. Not to rush a decision, but to make sure you know how to get ready for your moment.

Because every move (whether it’s next year or later) is smoother when it starts with a plan. And if you need help coming up with one that works, let’s connect.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

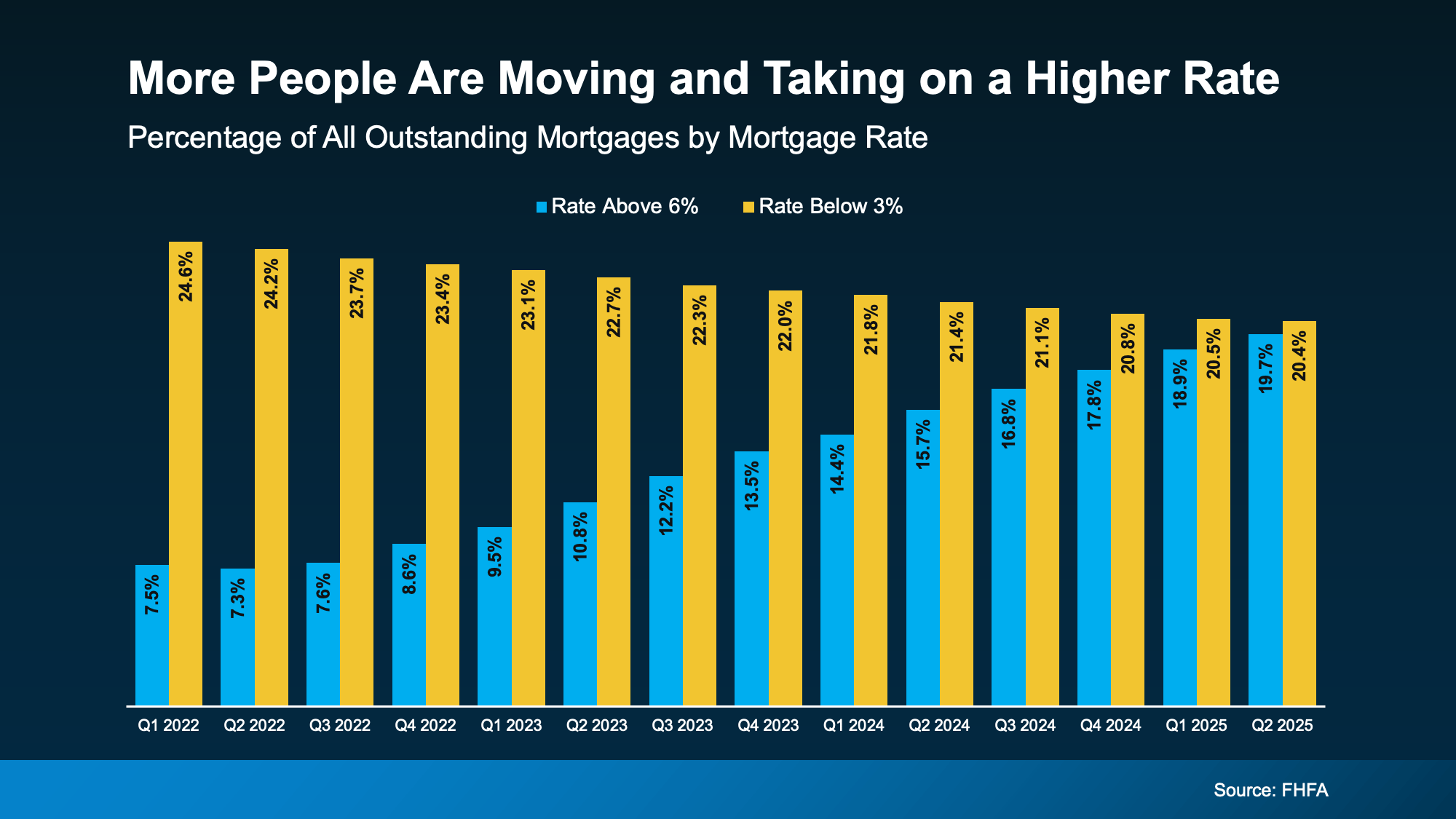

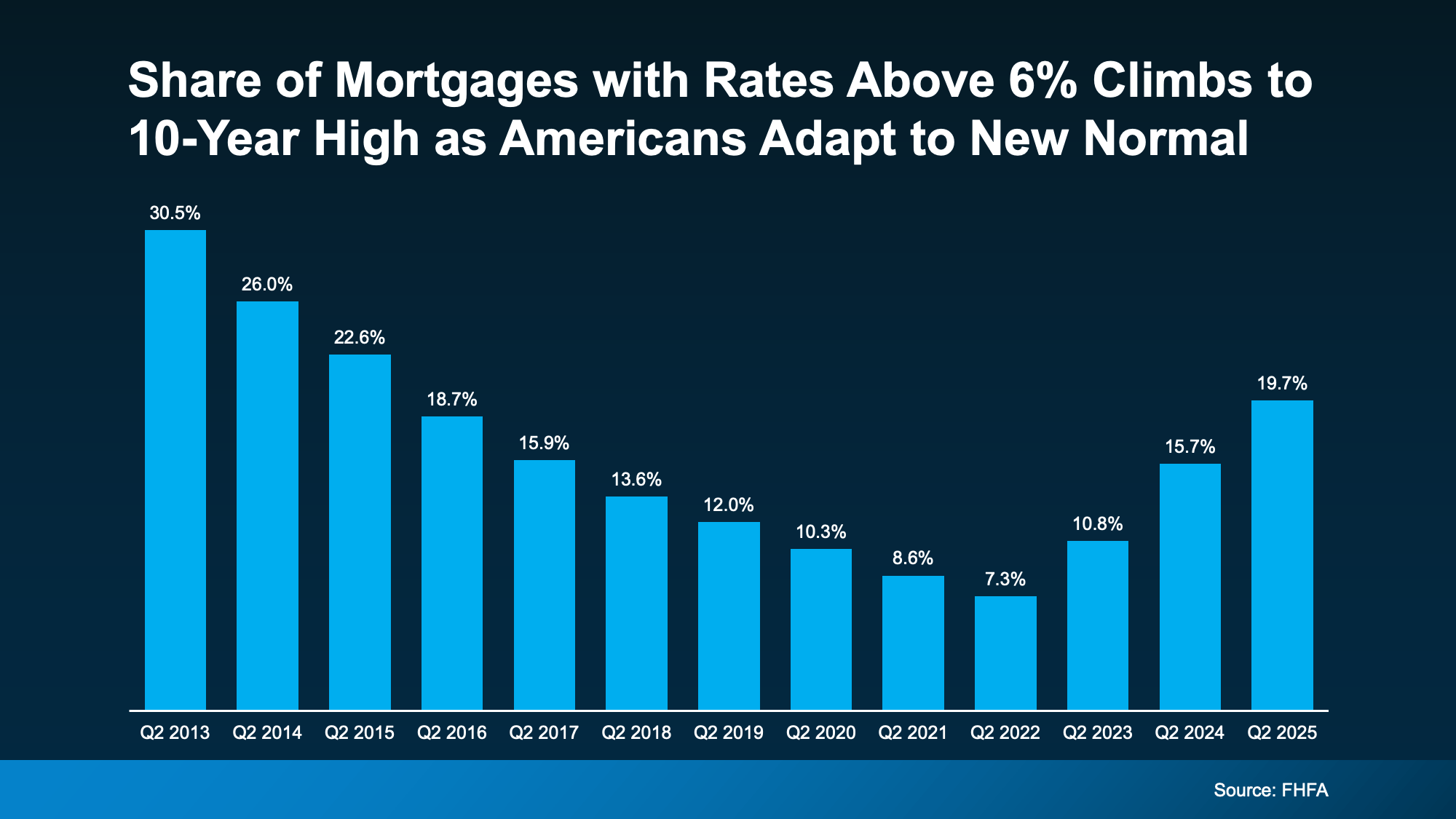

Why Are More People Moving Now, if It Means Taking on a Higher Rate?

Why Are More People Moving Now, if It Means Taking on a Higher Rate?

Zillow sums it up best:

Zillow sums it up best: