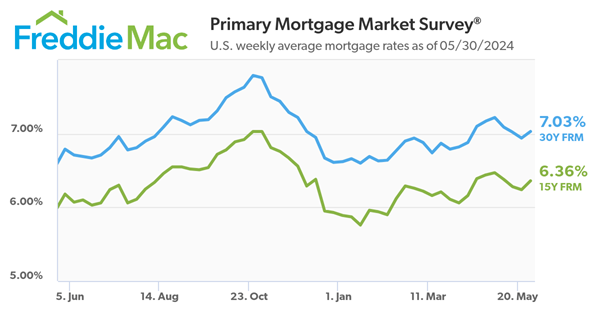

Freddie Mac (OTCQB: FMCC) today (May 30, 2024) released the results of its Primary Mortgage Market Survey® (PMMS®), showing the 30-year fixed-rate mortgage (FRM) averaged 7.03 percent.

“Following several weeks of decline, mortgage rates changed course this week,” said Sam Khater, Freddie Mac’s Chief Economist. “More hawkish commentary about inflation and tepid demand for longer-dated Treasury auctions caused market yields to rise across the board. This reality, as well as economic signals that have moved sideways over the last few weeks, have resulted in mortgage rates drifting higher as markets continue to dial back expectations of interest rate cuts.”

- The 30-year FRM averaged 7.03 percent as of May 30, 2024, up from last week when it averaged 6.94 percent. A year ago at this time, the 30-year FRM averaged 6.79 percent.

- The 15-year FRM averaged 6.36 percent, up from last week when it averaged 6.24 percent. A year ago at this time, the 15-year FRM averaged 6.18 percent.

The PMMS® is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20 percent down and have excellent credit.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link