Home Selling Checklist For Any Season

Winter Home Selling Checklist That Applies Year Round!

Some Highlights

- As you get ready to sell your house, focus on tasks that make it inviting, show it’s cared for, and boost your curb appeal.

- This list will help you get started, but don’t forget, a real estate professional will provide other helpful tips based on your specific situation.

- Let’s connect so you have advice on what you may want to do to get your house ready to sell this season.

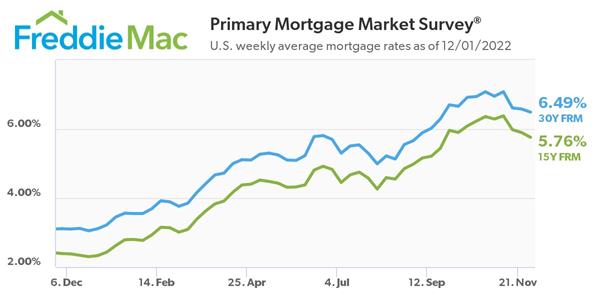

A Tick Down In Mortgage Interest Rates

Freddie Mac today released the results of its Primary Mortgage Market Survey® for the week ending Dec 1, 2022, showing the 30-year fixed-rate mortgage (FRM) averaged 6.49 percent.

“Mortgage rates continued to drop this week as optimism grows around the prospect that the Federal Reserve will slow its pace of rate hikes,” said Sam Khater, Freddie Mac’s Chief Economist. “Even as rates decrease and house prices soften, economic uncertainty continues to limit homebuyer demand as we enter the last month of the year.”

- 30-year fixed-rate mortgage averaged 6.49 percent as of December 1, 2022, down from last week when it averaged 6.58 percent. A year ago at this time, the 30-year FRM averaged 3.11 percent.

- 15-year fixed-rate mortgage averaged 5.76 percent, down from last week when it averaged 5.90 percent. A year ago at this time, the 15-year FRM averaged 2.39 percent.

Check with your mortgage lender for current mortgage rates. You can also check online sites such as Mortgage News Daily.

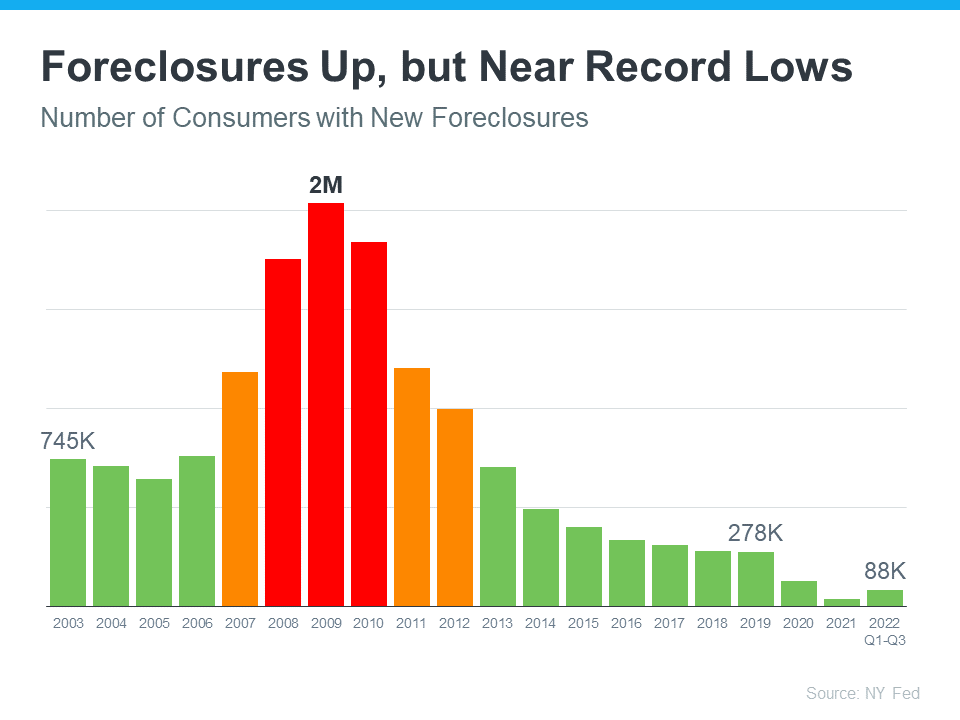

Why There Won’t Be a Flood of Foreclosures Coming to the Housing Market

With the rapid shift that’s happened in the housing market this year, some people are raising concerns that we’re destined for a repeat of the crash we saw in 2008. But in truth, there are many key differences between what’s happening today and the bubble in the early 2000s.

One of the reasons this isn’t like the last time is the number of foreclosures in the market is much lower now. Here’s a look at why there won’t be a wave of foreclosures flooding the market.

Not as Many Homeowners Are in Trouble This Time

After the last housing crash, over nine million households lost their homes due to a foreclosure, short sale, or because they gave it back to the bank. This was, in large part, because of more relaxed lending standards where people could take out mortgages they ultimately couldn’t afford. Those lending practices led to a wave of distressed properties which made their way into the market and caused home values to plummet.

But today, revised lending standards have led to more qualified buyers. As a result, there are fewer homeowners who are behind on their mortgages. As Marina Walsh, Vice President of Industry Analysis at the Mortgage Bankers Association (MBA), says:

“For the second quarter in a row, the mortgage delinquency rate fell to its lowest level since MBA’s survey began in 1979 – declining to 3.45%. Foreclosure starts and loans in the process of foreclosure also dropped in the third quarter to levels further below their historical averages.”

There Have Been Fewer Foreclosures over the Last Two Years

While you may have seen recent stories about the number of foreclosures rising today, context is important. During the pandemic, many homeowners were able to pause their mortgage payments using the forbearance program. The program gave homeowners facing difficulties extra time to get their finances in order and, in many cases, work out a plan with their lender.

With that program, many were concerned it would result in a wave of foreclosures coming to the market. That fear didn’t materialize. Data from the New York Fed shows there are still fewer foreclosures happening today than before the pandemic (see graph below):

That means, while there are more foreclosures now compared to last year (when foreclosures were paused), the number is still well below what the housing market has seen in a more typical year, like 2017-2019.

And most importantly, the number we’re seeing now is still far below the number we saw during the market crash (shown in the red bars in the graph). The big takeaway? Don’t let a headline in the news mislead you. While foreclosures are up year-over-year, historical context is essential to understanding the full picture.

Most Homeowners Have More Than Enough Equity To Sell Their Homes

Many homeowners today have enough equity to sell their homes instead of facing foreclosure. Due to rapidly rising home prices over the last two years, the average homeowner has gained record amounts of equity in their home. And if they’ve stayed in their homes even longer, they may have even more equity than they realize. As Ksenia Potapov, Economist at First American, says:

“Homeowners have very high levels of tappable home equity today, providing a cushion to withstand potential price declines, but also preventing housing distress from turning into a foreclosure. . . the result will likely be more of a foreclosure ‘trickle’ than a ‘tsunami.’”

A recent report from ATTOM Data explains it by going even deeper into the numbers:

“Only about 214,800 homeowners were facing possible foreclosure in the second quarter of 2022, or just four-tenths of one percent of the 58.2 million outstanding mortgages in the U.S. Of those facing foreclosure, about 195,400, or 91 percent, had at least some equity built up in their homes.”

Bottom Line

If you see headlines about the increasing number of foreclosures today, remember context is important. While it’s true the number of foreclosures is higher now than it was last year, foreclosures are still well below pre-pandemic years. If you have questions, let’s connect.

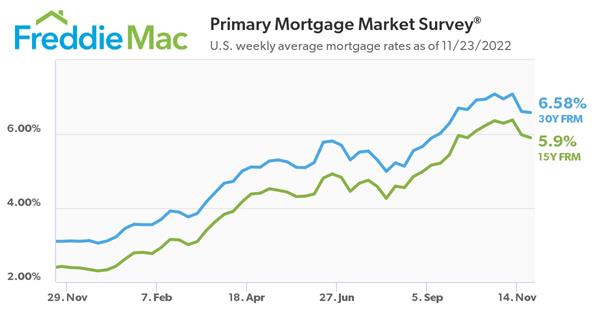

Mortgage Interest Rates Averaged 6.58% for the Week Ending 11/23/2022.

Freddie Mac released the results of its Primary Mortgage Market Survey (PMMS) 11/23/2022, showing the 30-year fixed-rate mortgage (FRM) averaged 6.58 percent. This week’s results include an adjustment for the observance of Thanksgiving.

“Mortgage rates continued to tick down heading into the Thanksgiving holiday,” said Sam Khater, Freddie Mac’s Chief Economist. “In recent weeks, rates have hit above seven percent only to drop by almost half a percentage point. This volatility is making it difficult for potential homebuyers to know when to get into the market, and that is reflected in the latest data which shows existing home sales slowing across all price points.”

- 30-year fixed-rate mortgage averaged 6.58 percent as of November 23, 2022, down from last week when it averaged 6.61 percent. A year ago at this time, the 30-year FRM averaged 3.10 percent.

- 15-year fixed-rate mortgage averaged 5.90 percent, down from last week when it averaged 5.98 percent. A year ago at this time, the 15-year FRM averaged 2.42 percent.

For more information on Mortgage Interest Rates check with your lender. You can also find daily mortgage interest information on sites such as Mortgage News Daily.

Want Your House To Be The #1 Item On A Homebuyer’s Wish List During The Holidays?

Each year, homeowners planning to make a move are faced with a decision: sell their house during the holidays or wait. And others who have already listed their homes may think about removing their listings and waiting until the new year to go back on the market.

The truth is many buyers want to purchase a home for the holidays, and your house might be just what they’re looking for. Here are five great reasons you shouldn’t wait to sell your house.

1. While the supply of homes for sale has increased this year, there still aren’t enough homes on the market to keep up with buyer demand. As Nadia Evangelou, Senior Economist & Director of Forecasting at the National Association of Realtors (NAR), explains:

“There’s still this gap between demand and supply because we were underbuilding for many years. . . . So now we see demand is slowing, but it still outpaces supply.”

2. Serious homebuyers are out looking right now. Millennials are driving homebuying demand today, and many are eager to make a purchase. Mark Fleming, Chief Economist at First American, explains:

“While not the frenzy of 2021, the largest living generation, the Millennials, will continue to age into their prime home-buying years, creating a demographic tailwind for the housing market.”

3. The desire to own a home doesn’t stop during the holidays. In fact, homes decorated for the holidays appeal to many buyers. Plus, purchasers who look for homes during the holidays are ready to buy.

4. You can restrict the showings in your house to days and times that are most convenient for you. That can help you minimize disruptions, which is especially important this time of year.

5. Rents have skyrocketed in recent years. And, many buyers are looking to escape rising rents and avoid falling into the rental trap for another year. As an article from Zillow says:

“Over the next 12 months, rents are expected to grow more than inflation, the stock market and home values.”

Your home could be their ticket to leaving renting behind for good.

Bottom Line

There are still many reasons it makes sense to list your house during the holiday season. Let’s connect to determine if selling now is your best move.

What Homeowners Want To Know About Selling in Today’s Market

If you’re thinking about selling your house, you’re likely hearing about the cooling housing market and wondering what that means for you. While it’s not the peak intensity we saw during the pandemic, we’re still in a sellers’ market. That means you haven’t missed your window. Realtor.com explains:

“. . . while prospective home sellers may lament that they missed their prime window, in reality, this is still a terrific time to sell. In fact, according to a recent Realtor.com® home seller survey, 95% of sellers who sold their home in the past year got more than they paid for it.

Nonetheless, some of the more prominent pandemic trends have changed, so sellers might wish to adjust accordingly to get the best deal possible.”

The key to success today is being realistic and working with a trusted real estate advisor who can help you set your expectations based on where the market is now, not where it was over the past few years.

Here are a few things experts say today’s sellers need to consider.

Be Willing To Negotiate

At the peak of the pandemic frenzy, sellers held all the leverage because inventory was at record lows and buyers were willing to enter bidding wars over homes that were available. This year, the supply of homes for sale has increased as the market cooled. Even though inventory is still low overall, buyers today have more options, and with that comes more negotiation power.

As a seller, that means you may see more buyers getting an inspection, requesting repairs, or asking for help with closing costs today. You need to be prepared to have those conversations. As Ali Wolf, Chief Economist at Zonda, says:

“Today’s market is different than it was just six months ago. . . Sellers that want the contract to move forward should be willing to work with the buyer. . . Consider helping with the closing costs or addressing many of the items on the home inspection list.”

Price Your Home at Market Value

It’s not just that the number of homes for sale has grown this year. Buyer demand has also pulled back in light of higher mortgage rates. As a result, pricing your house appropriately so you can catch the eyes of serious buyers is important. Greg McBride, Chief Financial Analyst at Bankrate, explains:

“Price your home realistically. This isn’t the housing market of April or May, so buyer traffic will be substantially slower, but appropriately priced homes are still selling quickly.”

You don’t want to overreach with your price and deter buyers. At the same time, you don’t want to undervalue your home and leave money on the table. This is another area where an agent’s expertise comes in handy.

Think About Your First Impression on Buyers

Buyers have more options and are more particular about their investment since it costs more to buy a home given today’s mortgage rates. As a result, you need to make sure your house shows well. As an article from realtor.com says:

“To stand out in the market, sellers should make their home attractive to buyers, which usually means some selective updates.”

This could include everything from staging the home, to making small cosmetic updates, tackling repairs, or undergoing renovations. A trusted real estate professional will help you assess what may be worthwhile to do compared to other recently sold homes in your area.

Bottom Line

To sum it all up, your house should still sell today and move quickly if you’re realistic about today’s market. As a press release from Zillow puts it:

“. . . sellers need to do things right to attract the attention of these buyers — pricing their home competitively and making their listing attractive to online home shoppers.”

For expert advice on how to quickly sell your house in a shifting market, let’s connect.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

![Winter Home Selling Checklist [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/11/17130959/Winter-Checklist-MEM-1046x1715.png)