Why Buying a Home Makes More Sense Than Renting Today

Wondering if you should continue renting or if you should buy a home this year? If so, consider this. Rental affordability is still a challenge and has been for years. That’s because, historically, rents trend up over time. Data from the Census shows rents have been climbing pretty steadily since 1988.

And, data from the latest rental report from Realtor.com shows rents continue to grow today, even though it’s at a slower pace than we saw at the height of the pandemic:

“In March 2023, the U.S. rental market experienced single-digit growth for the eighth month in a row . . . The median asking rent was $1,732, up by $15 from last month and down by $32 from the peak but is still $354 (25.7%) higher than the same time in 2019 (pre-pandemic).”

With rents much higher now than they were in more normal, pre-pandemic years, owning your home may be a better option, especially if the long-term trend of rents increasing each year continues. In contrast, homeowners with a fixed-rate mortgage can lock in a monthly mortgage payment for the duration of their loan (typically 15-30 years).

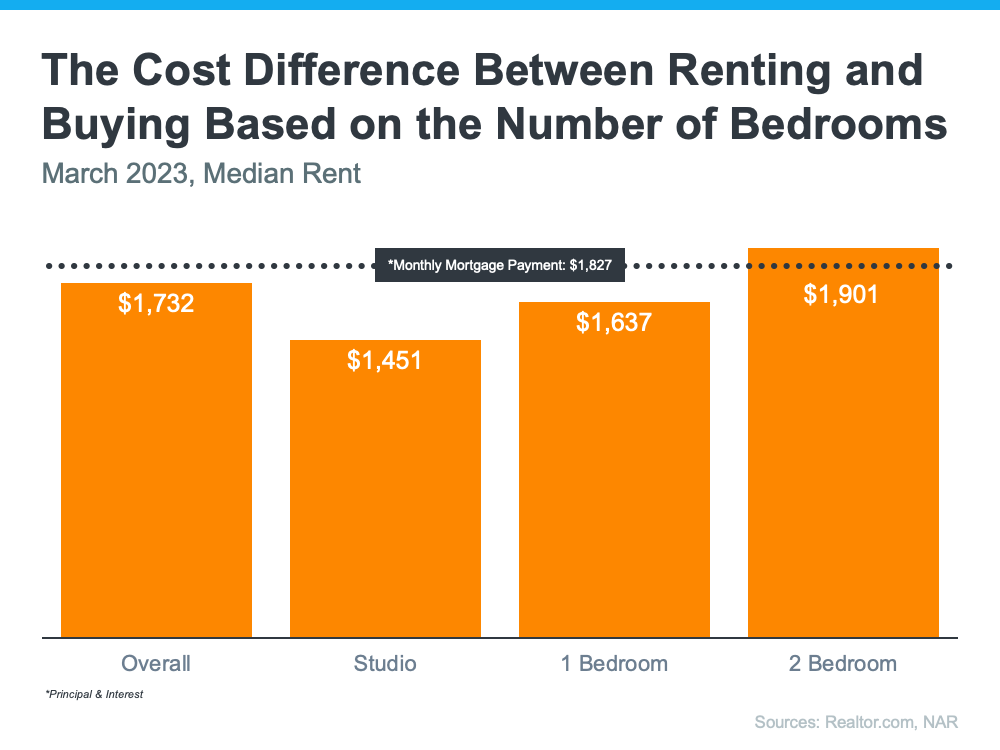

Owning a Home Could Be More Affordable if You Need More Space

The graph below uses national data on the median rental payment from Realtor.com and median mortgage payment from the National Association of Realtors (NAR) to compare the two options. As the graph shows, depending on how much space you need, it’s typically more affordable to own than to rent if you need two or more bedrooms:

So, if you’re looking to live somewhere where you have two or more bedrooms to accommodate your household, give you more breathing room to spread out your belongings, or dedicate the extra space to practice your hobbies, it might make sense to consider homeownership.

Homeownership Allows You To Start Building Equity

In addition to shielding you from rising rents and being more affordable when you need more space, owning your home also allows you to start building your own equity, which in turn grows your net worth.

And, as home values typically rise over time and you pay off your mortgage, you build equity. That equity can set you up for success later on because you can use it to help fuel a move to an even bigger space down the line. That’s why, according to Zonda, the top reason millennial homeowners bought their home over the past year was to build their own equity instead of someone else’s.

Bottom Line

If you’re trying to decide whether to buy a home or continue renting, let’s connect to explore your options. With rents rising, it may make more sense to pursue your dream of homeownership.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link