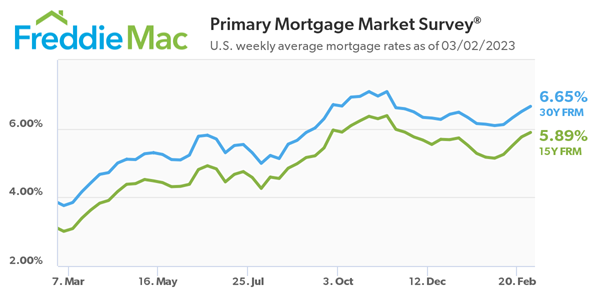

Freddie Mac (OTCQB: FMCC) today released the results of its Primary Mortgage Market Survey® (PMMS®) for the week ending today 03/02/2023, showing the 30-year fixed-rate mortgage (FRM) averaged 6.65 percent.

“As we started the year, the 30-year fixed-rate mortgage decreased with expectations of lower economic growth, inflation and a loosening of monetary policy. However, given sustained economic growth and continued inflation, mortgage rates boomeranged and are inching up toward seven percent,” said Sam Khater, Freddie Mac’s Chief Economist. “Lower mortgage rates back in January brought buyers back into the market. Now that rates are moving up, affordability is hindered and making it difficult for potential buyers to act, particularly for repeat buyers with existing mortgages at less than half of current rates.”

- 30-year fixed-rate mortgage averaged 6.65 percent as of March 2, 2023, up from last week when it averaged 6.50 percent. A year ago at this time, the 30-year FRM averaged 3.76 percent.

- 15-year fixed-rate mortgage averaged 5.89 percent, up from last week when it averaged 5.76 percent. A year ago at this time, the 15-year FRM averaged 3.01 percent.

The PMMS® is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20 percent down and have excellent credit.

Contact your mortgage lender for more information on daily mortgage interest rate movements. You may also find daily mortgage rate information online on sites such as Mortgage News Daily.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link