Selling your house is no simple task. While some homeowners opt to sell their homes on their own, known as a FSBO (For Sale by Owner), they often encounter various challenges without the guidance of a real estate agent. If you’re currently considering selling your house on your own, here’s what you should know.

The most recent Profile of Home Buyers and Sellers from the National Association of Realtors (NAR) surveyed homeowners who’d recently sold their own homes and asked what difficulties they faced. Those sellers say some of the greatest challenges were prepping their home for sale, pricing it right, and properly managing the required paperwork, just to name a few.

When it comes to selling your most valuable asset, consider the invaluable support that a real estate agent can provide. By partnering with an agent, you can navigate the complexities of the selling process with confidence. Here are just a few of the many ways an agent is essential to your home sale:

1. Marketing and Exposure

Effective marketing is a key piece of attracting qualified buyers to your property. Real estate agents have access to various marketing tools and platforms, including MLS listings, professional photography, virtual tours, and extensive professional networks. They can create a compelling listing that highlights your home’s best features and reaches a wider audience.

If you sell on your own, you may struggle to match the reach of agents, resulting in limited exposure and, ultimately, fewer potential buyers.

2. Managing Liability and Legal Considerations

Today, more disclosures and regulations are mandatory when selling a house. And all that paperwork and all the legal aspects of selling a home can be a lot to manage. Selling a house without professional guidance exposes homeowners to potential liability risks and legal complications.

Real estate agents are well-versed in the contracts, disclosures, and regulations necessary during a sale. Their expertise helps minimize the risk of errors or omissions that could lead to legal disputes or delays.

3. Negotiations and Contracts

Negotiating the terms of a home sale can be challenging, especially when emotions are involved. You may find it overwhelming to navigate these negotiations alone. Without an agent, you assume this responsibility on your own. This means you’ll have full accountability for working and negotiating with:

- The buyer, who wants the best deal possible.

- The buyer’s agent, who will use their expertise to advocate for the buyer.

- The home inspection company, who works for the buyer.

- The home appraiser, who assesses the property’s value to protect the lender.

Rather than going toe-to-toe with all these parties alone, lean on an expert. Real estate agents act as intermediaries, skillfully negotiating on your behalf and ensuring that your best interests are protected. They have experience in handling tough negotiations, counteroffers, and contingencies. When you sell your house yourself, you’ll need to be prepared to manage these vendors on your own.

4. Pricing and Housing Market Knowledge

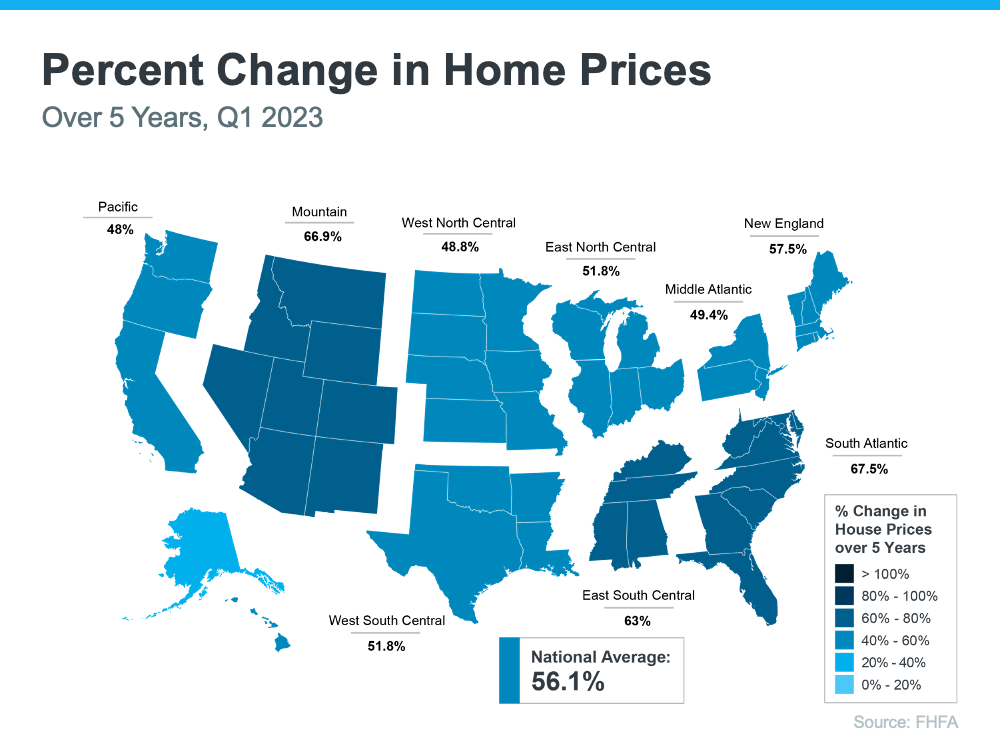

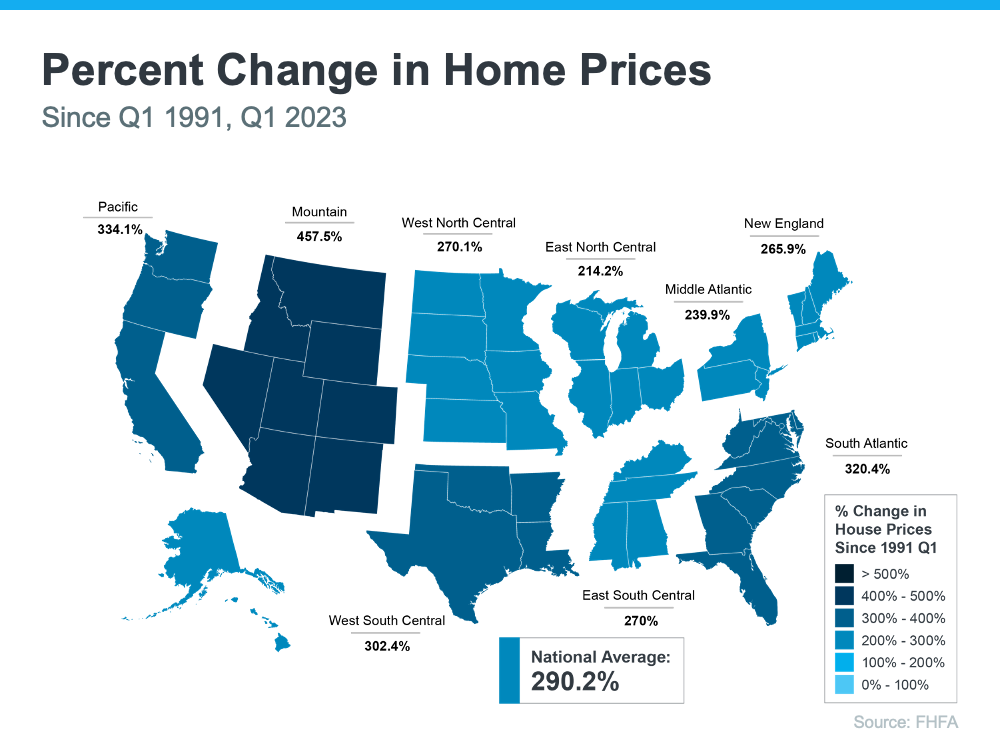

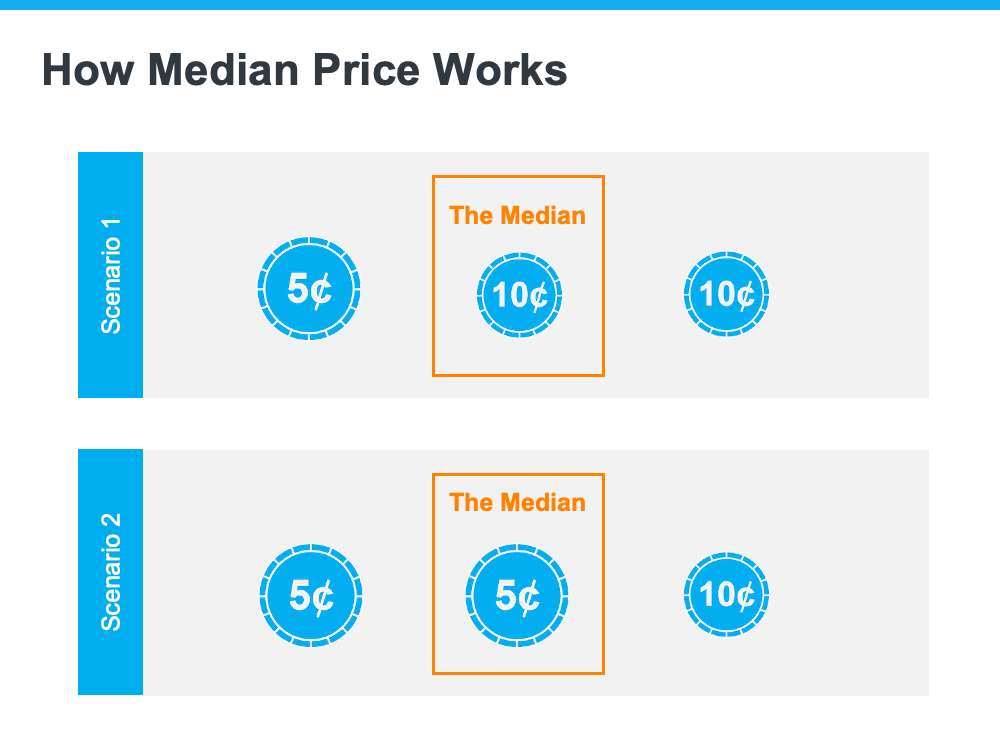

Determining the right asking price for your property is crucial. It requires in-depth knowledge of the local real estate market, including recent sales data, neighborhood trends, and the current demand for properties. Real estate agents have access to comprehensive market data and the expertise to analyze it accurately.

When you sell your house on your own without this comprehensive information, you risk overpricing or underpricing your home. This can result in an extended time on the market and also the risk of leaving money on the table – which decreases your future buying power. An agent is a key piece of the pricing puzzle.

Bottom Line

While selling a home on your own might seem appealing at first, the challenges that come with it can quickly become overwhelming. The expertise that a real estate agent brings to the table is vital for a successful sale. Instead of tackling it alone, let’s connect to make sure you have an expert on your side.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link