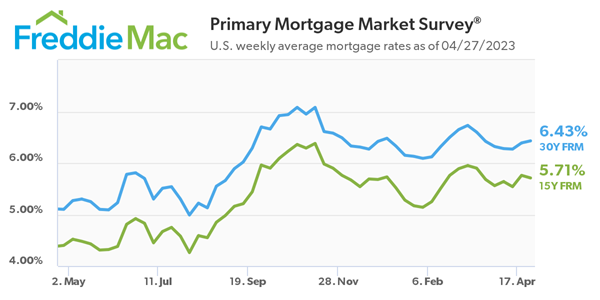

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing the 30-year fixed-rate mortgage (FRM) averaged 6.43 percent.

“The 30-year fixed-rate mortgage increased modestly for the second straight week, but with the rate of inflation decelerating rates should gently decline over the course of 2023,” said Sam Khater, Freddie Mac’s Chief Economist. “Incoming data suggest the housing market has stabilized from a sales and house price perspective. The prospect of lower mortgage rates for the remainder of the year should be welcome news to borrowers who are looking to purchase a home.”

- 30-year fixed-rate mortgage averaged 6.43 percent as of April 27, 2023, up from last week when it averaged 6.39 percent. A year ago at this time, the 30-year FRM averaged 5.10 percent.

- 15-year fixed-rate mortgage averaged 5.71 percent, down from last week when it averaged 5.76 percent. A year ago at this time, the 15-year FRM averaged 4.40 percent.

The PMMS® is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20 percent down and have excellent credit.

National Association of Realtors Economist Nadia Evangelou posted this reaction to the latest report from Freddie Mac.

In April, rates averaged 6.3%. At this rate, Americans need to put 20% down for a median-priced home if they don’t want their monthly mortgage payment to take up more than 25% of their income. However, data shows that nearly half of renters – 21 million renter households – spend more than 30% of their income on rent.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link