Toward the end of last year, there were a number of headlines saying home prices were going to fall substantially in 2023. That led to a lot of fear and questions about whether there was going to be a repeat of the housing crash that happened back in 2008. But the headlines got it wrong.

While there was a slight home price correction after the sky-high price appreciation during the ‘unicorn’ years, nationally, home prices didn’t come crashing down. If anything, prices were a lot more resilient than many people expected.

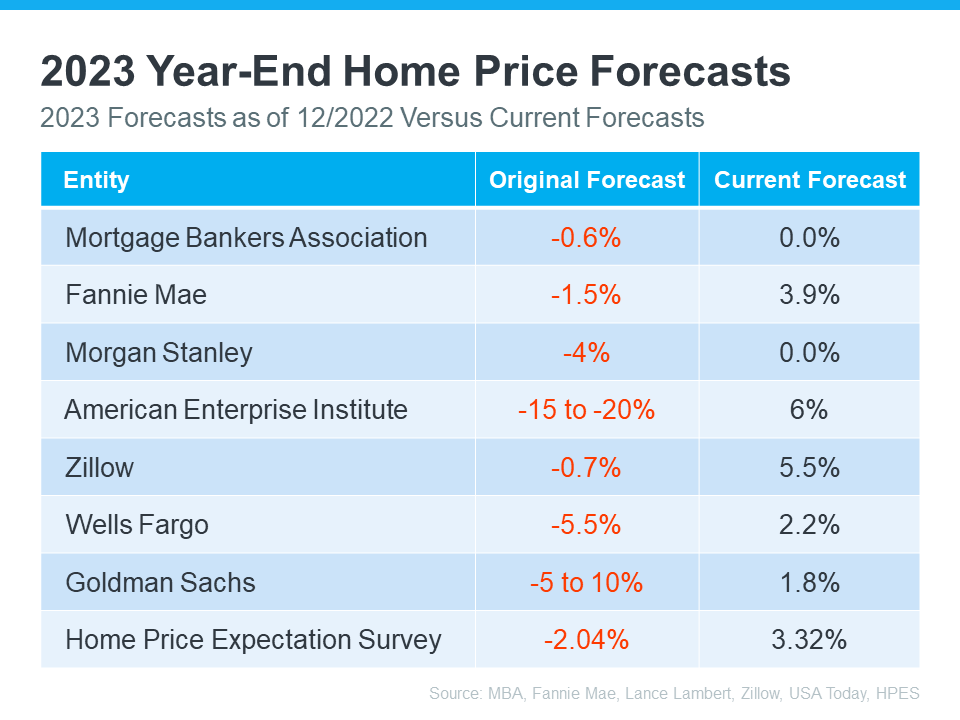

Let’s take a look at some of the expert forecasts from late last year stacked against their most recent forecasts to show that even the experts recognize they were overly pessimistic.

Expert Home Price Forecasts: Then and Now

This visual shows the 2023 home price forecasts from seven organizations. It provides the original 2023 forecasts (released in late 2022) for what would happen to home prices by the end of this year and their most recently revised 2023 forecasts (see chart below):

As the red in the middle column shows, in all instances, their original forecast called for home prices to fall. But, if you look at the right column, you’ll see all experts have updated their projections for the year-end to show they expect prices to either be flat or have positive growth. That’s a significant change from the original negative numbers.

As the red in the middle column shows, in all instances, their original forecast called for home prices to fall. But, if you look at the right column, you’ll see all experts have updated their projections for the year-end to show they expect prices to either be flat or have positive growth. That’s a significant change from the original negative numbers.

There are a number of reasons why home prices are so resilient to falling. As Odeta Kushi, Deputy Chief Economist at First American, says:

“One thing is for sure, having long-term, fixed-rate debt in the U.S. protects homeowners from payment shock, acts as an inflation hedge – your primary household expense doesn’t change when inflation rises – and is a reason why home prices in the U.S. are downside sticky.”

A Look Forward To Get Ahead of the Next Headlines

For home prices, you’re going to continue to see misleading media coverage in the months ahead. That’s because there’s seasonality to home price appreciation and they’re going to misunderstand that. Here’s what you need to know to get ahead of the next round of negative headlines.

As activity in the housing market slows at the end of this year (as it typically does each year), home price growth will slow too. But, this doesn’t mean prices are falling – it’s just that they’re not increasing as quickly as they were when the market was in the peak homebuying season.

Basically, deceleration of appreciation is not the same thing as home prices depreciating.

Bottom Line

The headlines have an impact, even if they’re not true. While the media said home prices would fall significantly in their coverage at the end of last year, that didn’t happen. Let’s connect so you have a trusted resource to help you separate fact from fiction with reliable data.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link