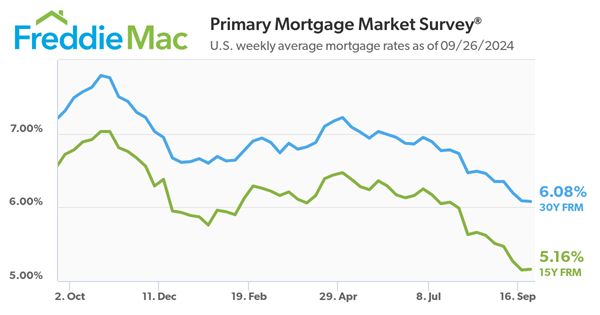

Freddie Mac today (09/26/2024) released the results of its Primary Mortgage Market Survey® (PMMS®), showing the 30-year fixed-rate mortgage (FRM) averaged 6.08 percent.

“Although this week’s decline was slight, the 30-year fixed-rate mortgage trended down to its lowest level in two years,” said Sam Khater, Freddie Mac’s Chief Economist. “Given the downward trajectory of rates, refinance activity continues to pick up, creating opportunities for many homeowners to trim their monthly mortgage payment. Meanwhile, many looking to purchase a home are playing the waiting game to see if rates decrease further as additional economic data is released over the next several weeks.”

- The 30-year FRM averaged 6.08 percent as of September 26, 2024, down from last week when it averaged 6.09 percent. A year ago at this time, the 30-year FRM averaged 7.31 percent.

- The 15-year FRM averaged 5.16 percent, up from last week when it averaged 5.15 percent. A year ago at this time, the 15-year FRM averaged 6.72 percent.

The PMMS® is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20 percent down and have excellent credit.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link