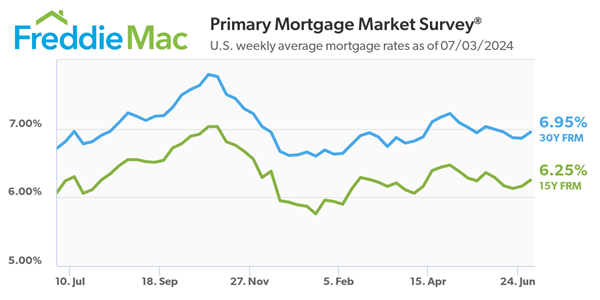

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing the 30-year fixed-rate mortgage (FRM) averaged 6.95 percent. This week’s results include an adjustment for the observance of Independence Day.

“Mortgage rates increased this week, coming in just under seven percent,” said Sam Khater, Freddie Mac’s Chief Economist. “Both new home and pending home sales are down, causing active listings to rise. We are still expecting rates to moderately decrease in the second half of the year and given additional inventory, price growth should temper, boding well for interested homebuyers.”

- The 30-year FRM averaged 6.95 percent as of July 3, 2024, up from last week when it averaged 6.86 percent. A year ago at this time, the 30-year FRM averaged 6.81 percent.

- The 15-year FRM averaged 6.25 percent, up from last week when it averaged 6.16 percent. A year ago at this time, the 15-year FRM averaged 6.24 percent.

The PMMS® is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20 percent down and have excellent credit.

Here’s Reaction from Dr. Jessica Lautz, Deputy Chief Economist and Vice President of Research at the National Association of REALTORS®.

Facts: The 30-year fixed mortgage rate from Freddie Mac increased to 6.95% over the last week from 6.86%. This is the first weekly increase since May 30. At 6.95%, with 20% down, a monthly mortgage payment on a home of $400,000 is $2,118.

Positive: While mortgage rates increased this week and affordability is bleak, there is also slightly more existing inventory coming onto the market. Home buyers at higher incomes may stand a chance to have their offer accepted as moderate-income buyers are forced to the sidelines—this is especially true of first-time buyers who have been largely shut out of the market.

Negative: The lock-in impact of higher rates for a prolonged period means someone who purchased or refinanced a $400,000 home at 3% vs. 6.95% would have a monthly mortgage payment of $1,349, a difference of $769 a month. This is unfathomable for many Americans, even with life changes.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link