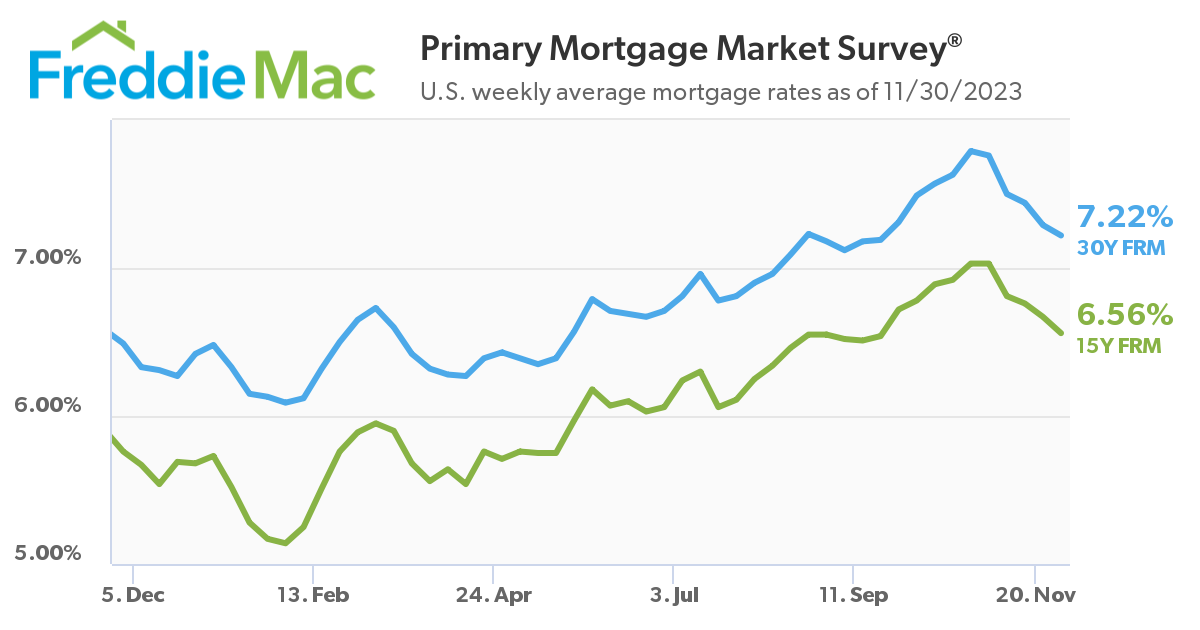

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing the 30-year fixed-rate mortgage (FRM) averaged 7.22 percent.

“Market sentiment has significantly shifted over the last month, leading to a continued decline in mortgage rates,” said Sam Khater, Freddie Mac’s Chief Economist. “The current trajectory of rates is an encouraging development for potential homebuyers, with purchase application activity recently rising to the same level as mid-September when rates were similar to today’s levels. The modest uptick in demand over the last month signals that there will likely be more competition in a market that remains starved for inventory.”

- The 30-year FRM averaged 7.22 percent as of November 30, 2023, down from last week when it averaged 7.29 percent. A year ago at this time, the 30-year FRM averaged 6.49 percent.

- The 15-year FRM averaged 6.56 percent, down from last week when it averaged 6.67 percent. A year ago at this time, the 15-year FRM averaged 5.76 percent.

The PMMS® is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20 percent down and have excellent credit.

Dr. Jessica Lautz is the Deputy Chief Economist and Vice President of Research at the National Association of REALTORS® had this reaction to this week’s drop in mortgage interest rates.

It seems clear mortgage interest rates have hit a peak in late October and are now headed south. Mortgage interest rates dropped again to 7.22% from 7.29% last week. That drop from the recent October 26 peak of 7.79% translates into a $ 125-a-month savings on a $400,000 mortgage, which is significant for many home buyers who may be able to use the savings to cover a monthly utility bill or commuting costs.

The drop in mortgage interest rates comes during a time often best for first-time home buyers in a low inventory environment. First-time buyers may have more success with a multiple-offer situation without the intense competition of spring and early summer. Especially now since housing inventory remains tight and even lower mortgage interest rates are expected this spring.

The Fed should have strong motivation to keep the Fed Funds Rates as is and consider cutting it as inflation continues to moderate. This will mean even lower mortgage interest rates in 2024.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link