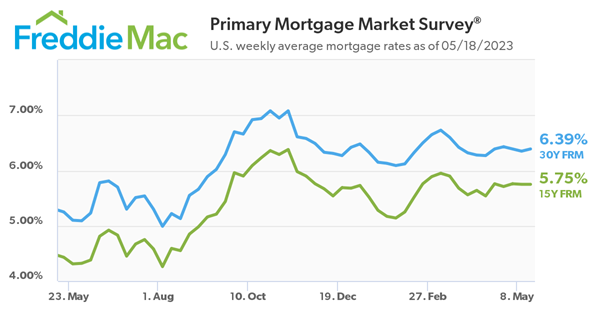

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing the 30-year fixed-rate mortgage (FRM) averaged 6.39 percent.

“The 30-year fixed-rate mortgage averaged 6.39 percent this week, as economic crosscurrents have kept rates within a ten-basis point range over the last several weeks,” said Sam Khater, Freddie Mac’s Chief Economist. “After the substantial slowdown in growth last fall, home prices stabilized during the winter and began to modestly rise over the last few months. This indicates that while affordability remains a hurdle, homebuyers are getting used to current rates and continue to pursue homeownership.”

- 30-year fixed-rate mortgage averaged 6.39 percent as of May 18, 2023, up from last week when it averaged 6.35 percent. A year ago at this time, the 30-year FRM averaged 5.25 percent.

- 15-year fixed-rate mortgage averaged 5.75 percent, unchanged from last week. A year ago at this time, the 15-year FRM averaged 4.43 percent.

NAR Senior Economist and Director of Real Estate Research Nadia Evangelou said of this week’s mortgage rate rise week that these fluctuations in rates will continue to persist, affecting the housing market as mortgage rates have a direct impact on the monthly mortgage payment. But with inflation easing further and the Federal Reserve expected to pause its rate hikes soon, mortgage rates will stabilize near 6% in the second half of the year.

With a 6.4% rate, the typical buyer can afford to purchase a home up to $380,000 – $9,000 or 2% less than the median-priced home if they put 20% down. About 45% of the listings are in this price range. For buyers who decide to put 14% down – the median down payment in 2022 – they will need to look for less expensive homes up to $355,000.

The PMMS® is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20 percent down and have excellent credit.

Check with your mortgage lender for more information on daily mortgage interest rate changes. You can also visits sites online such as Mortgage News Daily.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link