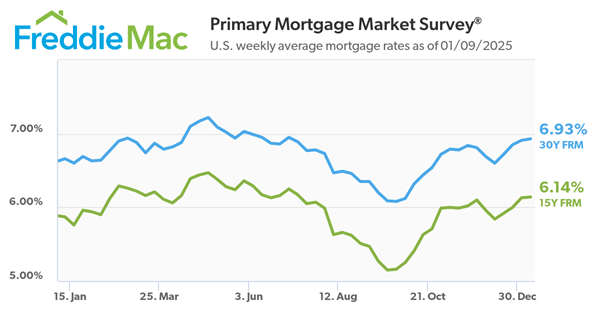

Freddie Mac today released the results of its Primary Mortgage Market Survey® for the week ending 01/09/2025, showing the 30-year fixed-rate mortgage (FRM) averaged 6.93 percent.

“In the first full week of the new year, the 30-year fixed-rate mortgage remained elevated at just under 7 percent,” said Sam Khater, Freddie Mac’s Chief Economist. “The continued strength of the economy has put upward pressure on mortgage rates, and along with high home prices, continues to impact housing affordability. The lack of entry-level supply also remains an issue, especially for those looking to become first-time homeowners.”

- The 30-year FRM averaged 6.93 percent as of January 9, 2025, up from last week when it averaged 6.91 percent. A year ago at this time, the 30-year FRM averaged 6.66 percent.

- The 15-year FRM averaged 6.14 percent, up from last week when it averaged 6.13 percent. A year ago at this time, the 15-year FRM averaged 5.87 percent.

The PMMS® is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20 percent down and have excellent credit.

Here’s reaction from NAR Deputy Chief Economist Jessica Lautz.

Facts: The average 30-year fixed mortgage rate from Freddie Mac rose to 6.93% from 6.91% last week. At 6.93%, with 20% down, a monthly mortgage payment is $2,114 on a home with a price of $400,000. With 10% down, the typical payment would be $2,378.

Positive: Despite the current affordability headwinds, there has been an increase in both pending and existing-home sales activity. Homeowners are making trades with housing equity gains, offsetting higher mortgage rates.

Negative: Rates hitting a 6-month high will plague first-time buyers who are more rate-sensitive. Mortgage applications declined last week as home buyers reacted to higher mortgage interest rates in late December/early January. Eyes will turn to home builders who borrow to build and watch rates acutely.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link