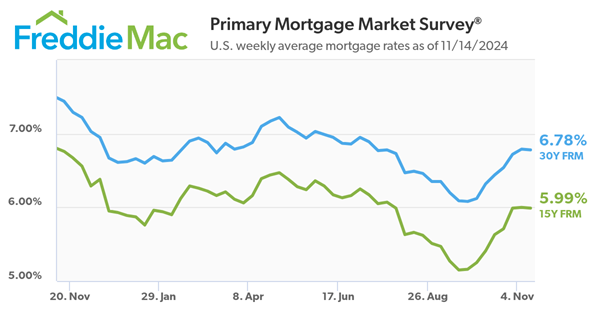

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing the 30-year fixed-rate mortgage (FRM) averaged 6.78 percent.

“After a six-week climb, rates have leveled off, but overall affordability continues to be an issue for potential homebuyers,” said Sam Khater, Freddie Mac’s Chief Economist. “Our latest research shows that mortgage payments compared to rents on the same homes are elevated relative to most of the last three decades.”

- The 30-year FRM averaged 6.78 percent as of November 14, 2024, down from last week when it averaged 6.79 percent. A year ago at this time, the 30-year FRM averaged 7.44 percent.

- The 15-year FRM averaged 5.99 percent, down from last week when it averaged 6.0 percent. A year ago at this time, the 15-year FRM averaged 6.76 percent.

Instant Reaction:

By: Jessica Lautz, Deputy Chief Economist and Vice President of Research at the National Association of REALTORS®.

Facts: The average 30-year fixed mortgage rate from Freddie Mac was essentially flat at 6.78% from 6.79% last week. At 6.78%, with 20% down, a monthly mortgage payment is $2,082 on a home with a price of $400,000. With 10% down, the typical payment would be $2,342.

Positive: Mortgage applications increased this week despite higher rates over the last few weeks. The election was decided, and buyers have resumed their search after an election pause. Even with a historically low share of first-time buyers, it is important to note that late Fall and Winter months are traditionally more favorable for first-time buyers as families bow out.

Negative: There have been two Fed rate cuts, and more are expected in 2025. However, these are not directly tied to mortgage interest rates, which are more closely tied to the 10-year treasury, which has increased in the last week. This week also showed inflation (down from last year but up from last month).

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link