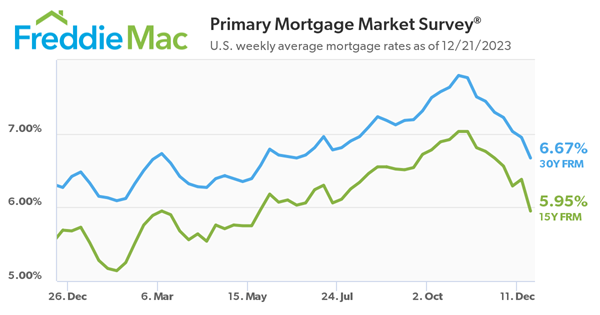

MCLEAN, Va., Dec. 21, 2023 Freddie Mac (OTCQB: FMCC) today released the results of its Primary Mortgage Market Survey® (PMMS®), showing the 30-year fixed-rate mortgage (FRM) averaged 6.67 percent.

“The 30-year fixed-rate mortgage remained below seven percent for the second week in a row, a welcome downward trend after 17 consecutive weeks above seven percent,” said Sam Khater, Freddie Mac’s Chief Economist. “Lower rates are bringing potential home buyers who were previously waiting on the sidelines back into the market and builders already are starting to feel the positive effects. A rise in home builder confidence, followed by new home construction reaching its highest level since May, signals a response to meet heightened demand as current inventory remains low.”

- The 30-year FRM averaged 6.67 percent as of December 21, 2023, down from last week when it averaged 6.95 percent. A year ago at this time, the 30-year FRM averaged 6.27 percent.

- The 15-year FRM averaged 5.95 percent, down from last week when it averaged 6.38 percent. A year ago at this time, the 15-year FRM averaged 5.69 percent.

The PMMS® is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20 percent down and have excellent credit.

Here’s reaction from Dr. Jessica Lautz the Deputy Chief Economist and Vice President of Research at the National Association of REALTORS®.

Mortgage interest rates continued to incrementally decline today, dropping to 6.67% from 6.95% last week. For a $400,000 home, this is a monthly mortgage payment of $2,059—a monthly savings of $242 from when rates were at 7.79% in October. Mortgage interest rates for the 30-year fixed are also nearly a full percentage below the historical average since 1971 of 7.74%.

First-time buyers traditionally fare better in the winter, as there is less competition from families in the home-buying market. November’s REALTORS Confidence Index shows first-time buyers up at 31% from 28% the past month. This represents a buying period when mortgage rates were still high. As rates ease considerably, can first-time buyers edge even closer to the norm (38% since 1981)?

Home buyers who have been priced out in the last year should find optimism in 2024.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link