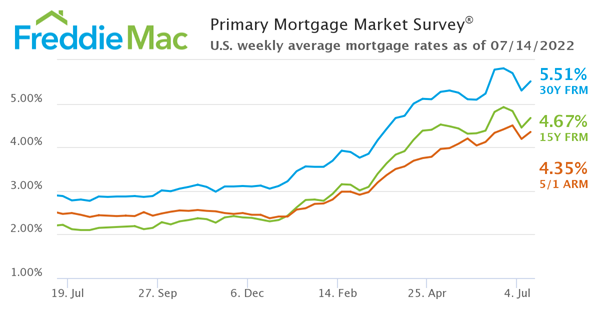

Freddie Mac today (07/14/2022) released the results of its Primary Mortgage Market Survey® (PMMS®), showing that the 30-year fixed-rate mortgage (FRM) averaged 5.51 percent.

“Mortgage rates are volatile as economic growth slows due to fiscal and monetary drags,” said Sam Khater, Freddie Mac’s Chief Economist. “With rates the highest in over a decade, home prices at escalated levels, and inflation continuing to impact consumers, affordability remains the main obstacle to homeownership for many Americans.”

- 30-year fixed-rate mortgage averaged 5.51 percent with an average 0.8 point as of July 14, 2022, up from last week when it averaged 5.30 percent. A year ago at this time, the 30-year FRM averaged 2.88 percent.

- 15-year fixed-rate mortgage averaged 4.67 percent with an average 0.8 point, up from last week when it averaged 4.45 percent. A year ago at this time, the 15-year FRM averaged 2.22 percent.

- 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 4.35 percent with an average 0.2 point, up from last week when it averaged 4.19 percent. A year ago at this time, the 5-year ARM averaged 2.47 percent.

For additional information on daily mortgage interest rate movements, check with your mortgage lender. You may also find information on line on mortgage rate movements on sites such as Mortgage News Daily .

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link