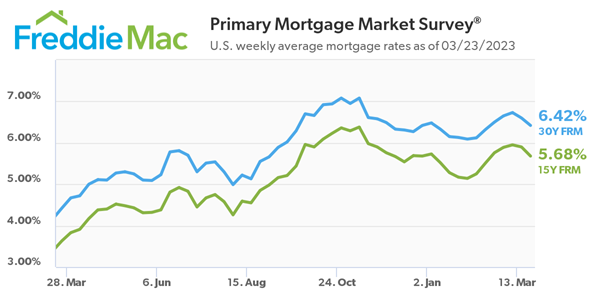

According to the latest Primary Mortgage Market Survey® (PMMS®) released by Freddie Mac on March 23, 2023, the 30-year fixed-rate mortgage (FRM) averaged 6.42 percent, which is a decrease from last week when it averaged 6.60 percent. However, it is higher than the 4.42 percent average of a year ago at the same time.

Similarly, the 15-year fixed-rate mortgage averaged 5.68 percent, down from last week when it averaged 5.90 percent, but higher than the 3.63 percent average of a year ago at the same time.

Sam Khater, Freddie Mac’s Chief Economist, attributed the slide in mortgage rates to financial market concerns over the past two weeks. He also noted that while the news is more positive on the homebuyer front with improved purchase demand and stabilizing home prices, a continued slide in mortgage rates over the next few weeks could result in a rebound during the first weeks of the spring homebuying season.

It is important to note that the PMMS® focuses on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20 percent down and have excellent credit.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link