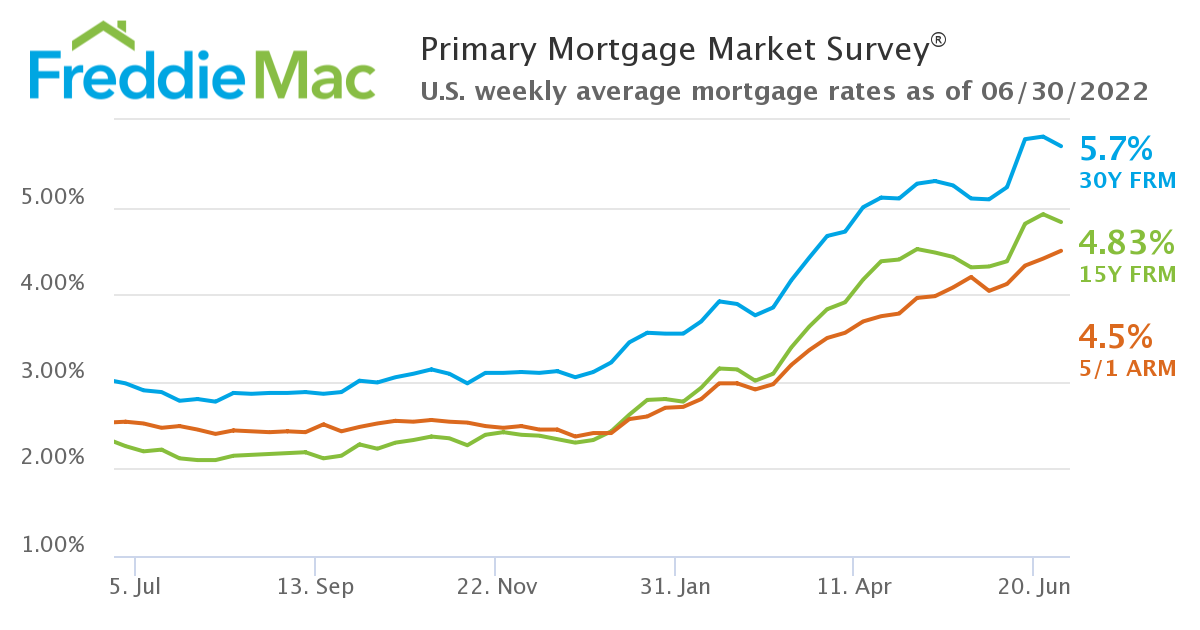

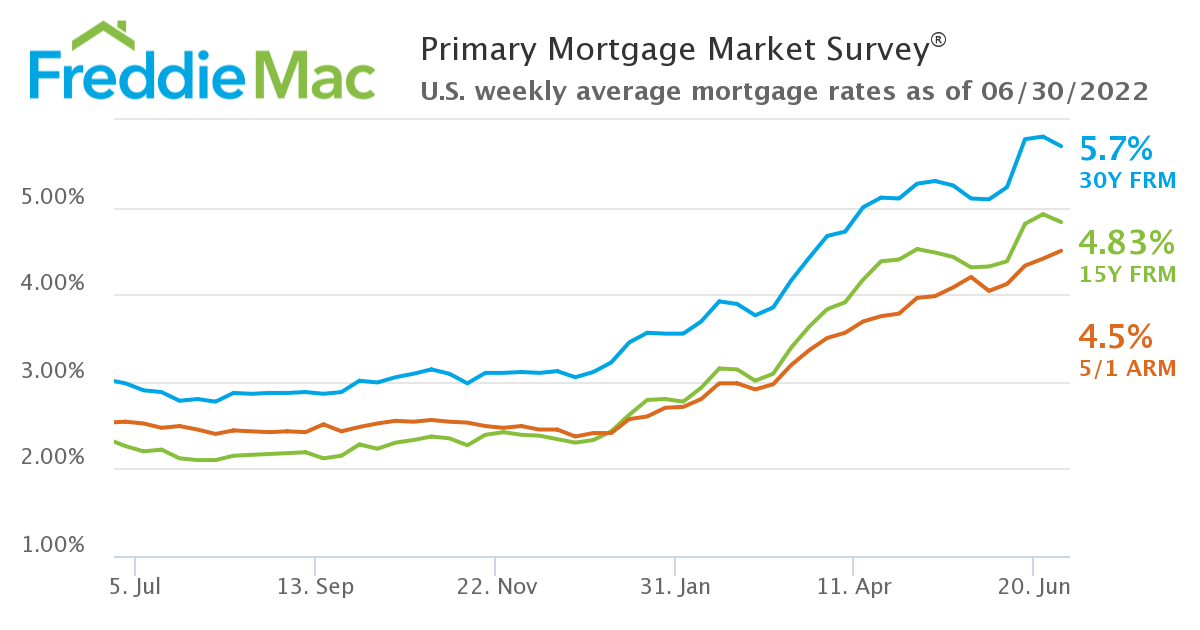

A little bit of a breather this week in the upward movement of mortgage interest rates.

Freddie Mac today released the results of its Primary Mortgage Market Survey (PMMS), showing that the 30-year fixed-rate mortgage (FRM) averaged 5.70 percent.

“The rapid rise in mortgage rates has finally paused, largely due to the countervailing forces of high inflation and the increasing possibility of an economic recession,” said Sam Khater, Freddie Mac’s Chief Economist. “This pause in rate activity should help the housing market rebalance from the breakneck growth of a seller’s market to a more normal pace of home price appreciation.”

- 30-year fixed-rate mortgage averaged 5.70 percent with an average 0.9 point as of June 30, 2022, down from last week when it averaged 5.81 percent. A year ago at this time, the 30-year FRM averaged 2.98 percent.

- 15-year fixed-rate mortgage averaged 4.83 percent with an average 0.9 point, down from last week when it averaged 4.92 percent. A year ago at this time, the 15-year FRM averaged 2.26 percent.

- 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 4.50 percent with an average 0.3 point, up from last week when it averaged 4.41 percent. A year ago at this time, the 5-year ARM averaged 2.54 percent.

For additional information on daily mortgage interest rate movements, check with your mortgage lender. You may also find information on daily mortgage rate movements at online sites such as Mortgage News Daily.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link