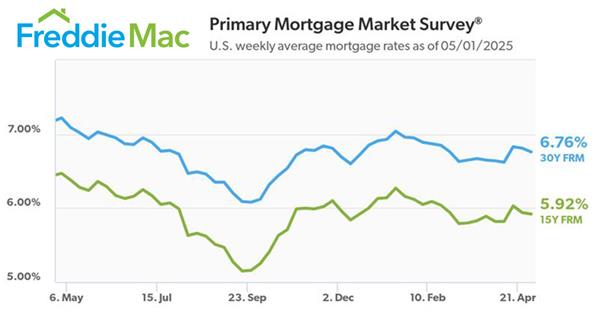

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing the 30-year fixed-rate mortgage (FRM) averaged 6.76% for the week ending May 1, 2025.

“Mortgage rates again declined this week,” said Sam Khater, Freddie Mac’s Chief Economist. “In recent weeks, rates for the 30-year fixed-rate mortgage have fallen even lower than the first quarter average of 6.83%.”

- The 30-year FRM averaged 6.76% as of May 1, 2025, down from last week when it averaged 6.81%. A year ago at this time, the 30-year FRM averaged 7.22%.

- The 15-year FRM averaged 5.92%, down from last week when it averaged 5.94%. A year ago at this time, the 15-year FRM averaged 6.47%.

The PMMS® is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20% down and have excellent credit.

Reaction from Dr. Jessica Lautz, Deputy Chief Economist and Vice President of Research at the National Association of REALTORS®.

Facts: The average 30-year fixed mortgage rate from Freddie Mac decreased to 6.76%, down from 6.81% last week. At this rate, with a 20% down payment, the monthly mortgage payment amounts to $2,078 for a home priced at $400,000. With a 10% down payment, the typical payment would be $2,337.

Positive: While mortgage rates are elevated, home buyers have more negotiating power than they did over the last several years, with more inventory. Repeat buyers have reaped stacks of cash from housing equity, allowing for all-cash purchases and hefty downpayments, offsetting higher rates.

Negative: Mortgage applications eased this week. GDP eased, but it was a cloudy picture at best, as the import of goods increased. Justified or not, consumers can be reticent to make any large purchases, including a new home, when there is uncertainty in the air. Eyes will be on the job report tomorrow as steady employment means higher home sales.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link