Mortgage rates remined flat this week.

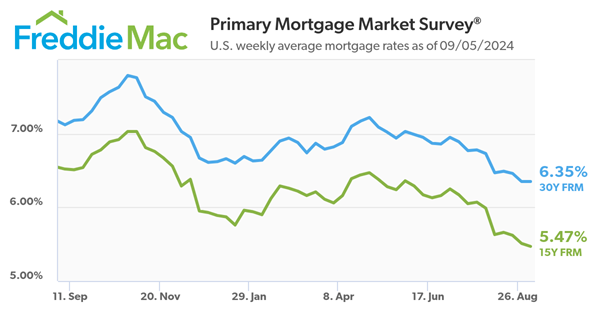

Freddie Mac (OTCQB: FMCC) today released the results of its Primary Mortgage Market Survey® (PMMS®), showing the 30-year fixed-rate mortgage (FRM) averaged 6.35 percent.

“Mortgage rates remained flat this week as markets await the release of the highly anticipated August jobs report,” said Sam Khater, Freddie Mac’s Chief Economist. “Even though rates have come down over the summer, home sales have been lackluster. On the refinance side however, homeowners who bought in recent years are taking advantage of declining mortgage rates in order to lower their monthly payments.”

- The 30-year FRM averaged 6.35 percent as of September 5, 2024, unchanged from last week. A year ago at this time, the 30-year FRM averaged 7.12 percent.

- The 15-year FRM averaged 5.47 percent, down from last week when it averaged 5.51 percent. A year ago at this time, the 15-year FRM averaged 6.52 percent.

The PMMS® is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20 percent down and have excellent credit.

Here’s reaction from National Association of Realtors Deputy Chief Economist and VP of Research, Jessica Lutz

Facts: The average 30-year fixed mortgage rate from Freddie Mac remained unchanged at 6.35% this week from last week. At 6.35%, with 20% down, a monthly mortgage payment on a home with a price of $400,000 is $1,991. With 10% down, the typical payment would be $2,240.

Positive: Although mortgage rates did not move, there was a slight increase in mortgage applications for purchase from the Mortgage Bankers Association. Some buyers are taking advantage of lower rates and more housing inventory.

Negative: While mortgage rates are significantly lower than in recent months, anticipation of a Fed rate cut in two weeks may have buyers reticent to jump in so they can wait for even lower rates. However, as nearly everyone has forecasted a Fed Funds rate cut, it is unlikely to lower mortgage interest rates significantly.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link