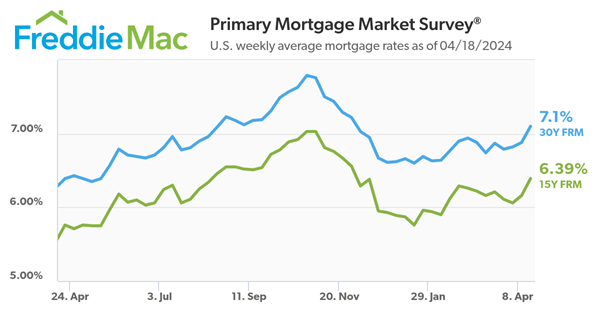

Mortgage rates averaging above 7 per cent. Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing the 30-year fixed-rate mortgage (FRM) averaged 7.10 percent.

“The 30-year fixed-rate mortgage surpassed 7 percent for the first time this year, jumping from 6.88 percent to 7.10 percent this week,” said Sam Khater, Freddie Mac’s Chief Economist. “As rates trend higher, potential homebuyers are deciding whether to buy before rates rise even more or hold off in hopes of decreases later in the year. Last week, purchase applications rose modestly, but it remains unclear how many homebuyers can withstand increasing rates in the future.”

- The 30-year FRM averaged 7.10 percent as of April 18, 2024, up from last week when it averaged 6.88 percent. A year ago at this time, the 30-year FRM averaged 6.39 percent.

- The 15-year FRM averaged 6.39 percent, up from last week when it averaged 6.16 percent. A year ago at this time, the 15-year FRM averaged 5.76 percent.

The PMMS® is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20 percent down and have excellent credit.

Here’s reaction from Dr. Jessica Lautz is the Deputy Chief Economist and Vice President of Research at the National Association of REALTORS®.

Mortgage interest rates increased to 7.1% this week, moving above the mid-6% range for the first time since December 2023. While the higher mortgage rates are determined to be a killjoy for the spring housing market, mortgage applications did increase. It seems those applying for mortgages may be trying to sneak in applications as rates moved higher in recent weeks.

For consumers trying to time the market for the perfect rate versus home prices, it is all an equation of not only housing needs but affordability. For buyers juggling the equation, home prices have increased to the highest price ever for the month of March, and 29% sold above the asking price for the home. As the intensity of the spring market reaches a peak in June, it may be better to act before the bidding wars over limited homes on the market gain further traction.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link