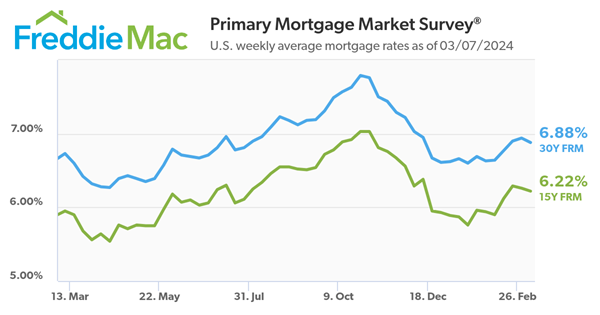

Freddie Mac today (March 07, 2024 )released the results of its Primary Mortgage Market Survey® (PMMS®), showing the 30-year fixed-rate mortgage (FRM) averaged 6.88 percent.

“Evidence that purchase demand remains sensitive to interest rate changes was on display this week, as applications rose for the first time in six weeks in response to lower rates,” said Sam Khater, Freddie Mac’s Chief Economist. “Mortgage rates continue to be one of the biggest hurdles for potential homebuyers looking to enter the market. It’s important to remember that rates can vary widely between mortgage lenders so shopping around is essential.”

- The 30-year FRM averaged 6.88 percent as of March 7, 2024, down from last week when it averaged 6.94 percent. A year ago at this time, the 30-year FRM averaged 6.73 percent.

- The 15-year FRM averaged 6.22 percent, down from last week when it averaged 6.26 percent. A year ago at this time, the 15-year FRM averaged 5.95 percent.

The PMMS® is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20 percent down and have excellent credit.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link