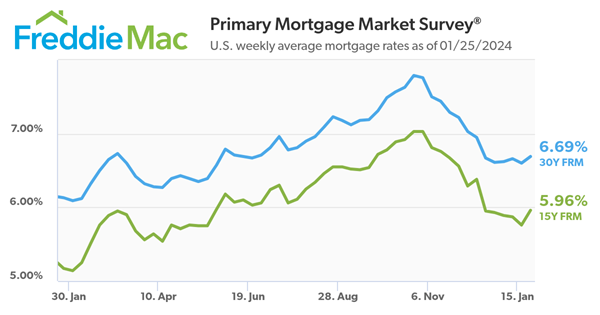

Freddie Mac today (01/25/2024) released the results of its Primary Mortgage Market Survey® (PMMS®), showing the 30-year fixed-rate mortgage (FRM) averaged 6.69 percent.

“The 30-year fixed-rate has remained within a very narrow range over the last month, settling in at 6.69% this week,” said Sam Khater, Freddie Mac’s Chief Economist. “Given this stabilization in rates, potential homebuyers with affordability concerns have jumped off the fence back into the market. Despite persistent inventory challenges, we anticipate a busier spring homebuying season than 2023, with home prices continuing to increase at a steady pace.”

- The 30-year FRM averaged 6.69 percent as of January 25, 2024, up from last week when it averaged 6.60 percent. A year ago at this time, the 30-year FRM averaged 6.13 percent.

- The 15-year FRM averaged 5.96 percent, up from last week when it averaged 5.76 percent. A year ago at this time, the 15-year FRM averaged 5.17 percent.

The PMMS® is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20 percent down and have excellent credit.

Mortgage Interest Rate News Reaction: Dr. Jessica Lautz, Deputy Chief Economist and Vice President of Research at the National Association of REALTORS®.

For the sixth consecutive week, mortgage interest rates stayed in the range of 6.6% and are now at 6.69%. Home buyers are responding to the lowering of mortgage interest rates, and foot traffic (according to SentriLock, LLC., a lockbox company) improved—increasing 5% year-over-year in December. Mortgage applications are also encouraging, with applications up 3.7% from a week prior. New home sales also increased.

For a home buyer shopping for a single-family existing home, the median home price was $387,000 in December. The median price for a new single-family home was $413,200. A buyer purchasing an existing home with a 20% downpayment would have a median monthly mortgage payment of $1,996. A buyer purchasing a new home with a 20% downpayment would have a monthly mortgage payment of $2,131.

There is no question that 2023 was a rough year in housing, but there are plenty of reasons to see optimism in 2024. Lower mortgage interest rates will have buyers and sellers reconsider sitting on the sidelines. Family changes, new jobs, and retirements have happened and will continue to happen, and housing consumers will need to find new locations and homes that fit their lifestyles.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link