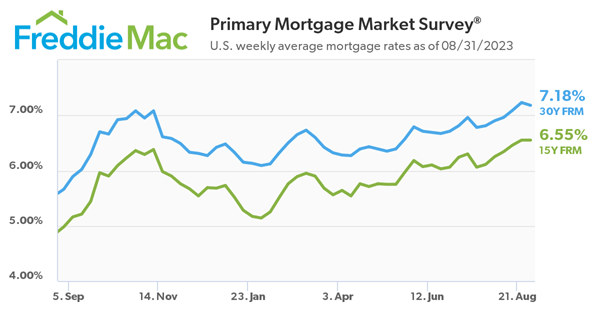

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing the 30-year fixed-rate mortgage (FRM) averaged 7.18 percent.

“Mortgage rates leveled off this week but remain elevated. Despite continued high rates, low inventory is keeping house prices steady,” said Sam Khater, Freddie Mac’s Chief Economist. “Recent volatility makes it difficult to forecast where rates will go next, but we should have a better gauge in September as the Federal Reserve determines their next steps regarding interest rate hikes.”

- 30-year fixed-rate mortgage averaged 7.18 percent as of August 31, 2023, down from last week when it averaged 7.23 percent. A year ago at this time, the 30-year FRM averaged 5.66 percent.

- 15-year fixed-rate mortgage averaged 6.55 percent, unchanged from last week. A year ago at this time, the 15-year FRM averaged 4.98 percent.

The PMMS® is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20 percent down and have excellent credit

NAR Instate Reaction: by Jessica Lautz – Deputy Chief Economist and Vice President of Research

There was virtually no change to the already elevated mortgage interest rates in the last week. Rates declined slightly from a high of 7.23% to a still high rate of 7.18%. The lack of movement is discouraging to home buyers who are also facing higher home prices.

At a rate of 7.18%, a buyer would have a monthly mortgage of $2,234 for an existing single-family home and $1,938 for an existing condo. In the West, where buyers are rebounding into the market, the typical existing-home price is $610,500, which translates into a monthly mortgage payment of $3,309. The Midwest continues to be the most affordable region to purchase a home, with a median price of $304,600—a typical monthly payment of $1,651.

Until the Fed makes the right decision on the Fed Funds Rate, buyers will continue to see higher home buying costs. These higher rates will continue to exacerbate housing inequality and limit the number of first-time and minority buyers.

Dr. Jessica Lautz is the Deputy Chief Economist and Vice President of Research at the National Association of REALTORS®.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link