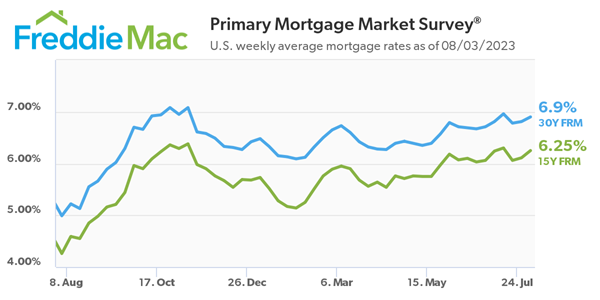

Freddie Mac today (08/03/2023) released the results of its Primary Mortgage Market Survey® (PMMS®), showing the 30-year fixed-rate mortgage (FRM) averaged 6.90 percent.

“The combination of upbeat economic data and the U.S. government credit rating downgrade caused mortgage rates to rise this week,” said Sam Khater, Freddie Mac’s Chief Economist. “Despite higher rates and lower purchase demand, home prices have increased due to very low unsold inventory.”

- 30-year fixed-rate mortgage averaged 6.90 percent as of August 3, 2023, up from last week when it averaged 6.81 percent. A year ago at this time, the 30-year FRM averaged 4.99 percent.

- 15-year fixed-rate mortgage averaged 6.25 percent, up from last week when it averaged 6.11 percent. A year ago at this time, the 15-year FRM averaged 4.26 percent.

The PMMS® is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20 percent down and have excellent credit.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link