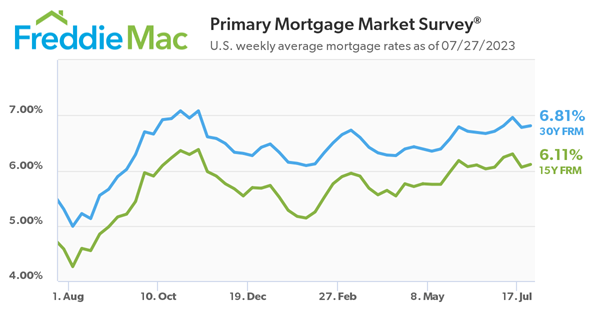

Freddie Mac (OTCQB: FMCC) today released the results of its Primary Mortgage Market Survey® (PMMS®), showing the 30-year fixed-rate mortgage (FRM) averaged 6.81 percent.

“Mortgage rates inched up slightly after a significant decline last week,” said Sam Khater, Freddie Mac’s Chief Economist. “Higher interest rates continue to dampen activity in interest rate-sensitive sectors, such as housing. However, overall U.S. consumer confidence is unwavering, surging to a two-year high in the Conference Board’s Consumer Confidence Index for July 2023. Rising consumer confidence often leads to greater spending, which could drive more consumers into the housing market.”

- 30-year fixed-rate mortgage averaged 6.81 percent as of July 27, 2023, up from last week when it averaged 6.78 percent. A year ago at this time, the 30-year FRM averaged 5.30 percent.

- 15-year fixed-rate mortgage averaged 6.11 percent, up from last week when it averaged 6.06 percent. A year ago at this time, the 15-year FRM averaged 4.58 percent.

The PMMS® is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20 percent down and have excellent credit.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link