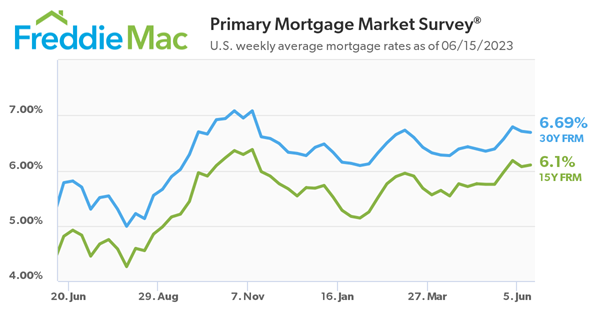

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing the 30-year fixed-rate mortgage (FRM) averaged 6.69 percent.

“Mortgage rates decreased slightly this week in anticipation of the pause in rate hikes by the Federal Reserve,” said Sam Khater, Freddie Mac’s Chief Economist. “As inflation continues to decelerate, economic growth is slowing and the tightening cycle of monetary policy is reaching its apex, which means mortgage rates are expected to decrease later this year and into next.”

- 30-year fixed-rate mortgage averaged 6.69 percent as of June 15, 2023, down from last week when it averaged 6.71 percent. A year ago at this time, the 30-year FRM averaged 5.78 percent.

- 15-year fixed-rate mortgage averaged 6.10 percent, up from last week when it averaged 6.07 percent. A year ago at this time, the 15-year FRM averaged 4.81 percent.

Nadia Evangelou Senior Economist & Director of Real Estate Research for the National Association of REALTORS® had this reaction to today’s PMMS survey release; Two of the main factors driving today’s mortgage market have become more favorable. Inflation dropped to 4%, and the Federal Reserve paused its interest rate hikes after raising rates for more than a year. Data also indicates that inflation may ease even faster in the following months. The latest release shows that CPI rent growth has already peaked and started to cool. With this decelerating trend in rent prices to persist in the upcoming months – following the trend of asking rent prices reported by the private sector – inflation will slow down further, pulling down mortgage rates. At the current mortgage rate, renters who pay $1,655 monthly for rent can spend the same amount on a monthly mortgage payment for a home with a value of $321,000.

For more information on daily mortgage interest rate movements, contact your mortgage lender.

The PMMS® is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20 percent down and have excellent credit.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link