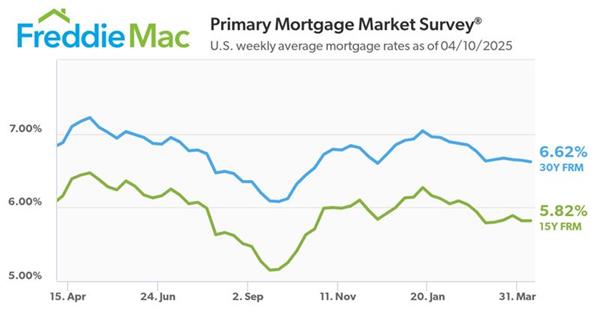

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing the 30-year fixed-rate mortgage (FRM) averaged 6.62%.

“The average 30-year fixed-rate mortgage continues to trend down, remaining under 7% for the twelfth consecutive week,” said Sam Khater, Freddie Mac’s Chief Economist. “As purchase applications continue to climb, the spring homebuying season is shaping up to look more favorable than last year.”

- The 30-year FRM averaged 6.62% as of April 10, 2025, down from last week when it averaged 6.64%. A year ago at this time, the 30-year FRM averaged 6.88%.

- The 15-year FRM averaged 5.82%, unchanged from last week. A year ago at this time, the 15-year FRM averaged 6.16%.

The PMMS® is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20% down and have excellent credit.

Here’s Reaction from National Association of Realtors Deputy Economist Jessica Lautz:

Facts: The average 30-year fixed mortgage rate from Freddie Mac decreased to 6.62%, down from 6.64% last week. At this rate, with a 20% down payment, the monthly mortgage payment amounts to $2,048 for a home priced at $400,000. With a 10% down payment, the typical payment would be $2,304.

Level set: The 30-year fixed mortgage has been on a roller coaster ride this week, and the weekly average is below today’s mortgage rate quotes. This is due to the bond market reacting in real time to real-time decisions. Home buyers could have locked in the lowest rates seen in months earlier this week.

Watch: As a reaction to the mortgage rate turbulence, savvy shoppers jumped on lower rates, and mortgage applications increased 20%. If home buyers are ready to buy and on solid financial footing, stay in close contact to find the perfect home and lock in the lowest rate amid daily changes.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link