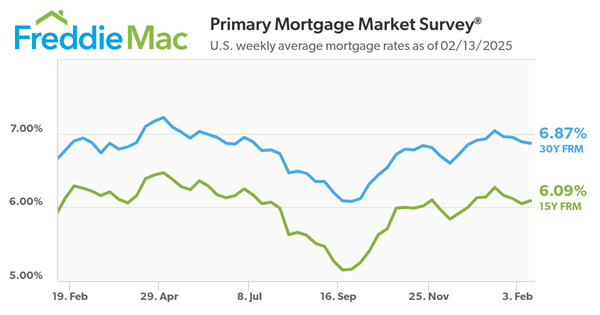

Freddie Mac (OTCQB: FMCC) today released the results of its Primary Mortgage Market Survey® (PMMS®), showing the 30-year fixed-rate mortgage (FRM) averaged 6.87%.

“The 30-year fixed-rate mortgage continued to inch down this week, reaching its lowest level thus far in 2025,” said Sam Khater, Freddie Mac’s Chief Economist. “Recent mortgage rate stability is benefitting potential buyers, as purchase demand is stronger than this time last year. This is an indication that a thaw in buyer activity could be on the horizon.”

- The 30-year FRM averaged 6.87% as of February 13, 2025, down from last week when it averaged 6.89%. A year ago at this time, the 30-year FRM averaged 6.77%.

- The 15-year FRM averaged 6.09%, up from last week when it averaged 6.05%. A year ago at this time, the 15-year FRM averaged 6.12%.

The PMMS® is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20% down and have excellent credit.

Here’s reaction from Dr. Jessica Lautz, Deputy Chief Economist and Vice President of Research at the National Association of REALTORS®.

Facts: The average 30-year fixed mortgage rate from Freddie Mac fell to 6.87% from 6.89% last week. At 6.87%, with a 20% down payment, the monthly mortgage payment is $2,101 for a home priced at $400,000. With 10% down, the typical payment would be $2,364.

Positive: Mortgage interest rates have decreased for four consecutive weeks. This timing is encouraging as home buyers begin to enter the early Spring housing market, and mortgage applications have also risen. If housing inventory continues to grow, home buyers will find themselves in a more favorable position compared to previous years.

Negative: Although rates are lower on a weekly basis, the overall housing affordability equation considers the price of the home alongside expenses such as utilities, taxes, and insurance.

-o-

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link