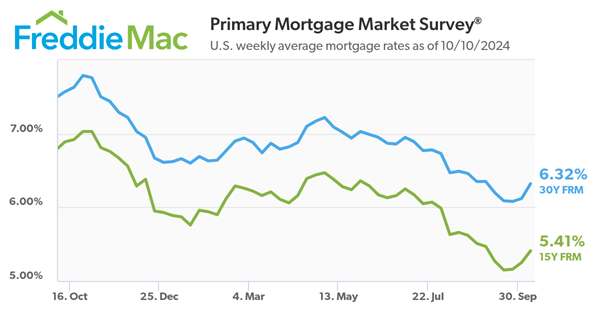

Freddie Mac (OTCQB: FMCC) today (Oct. 10, 2024 released the results of its Primary Mortgage Market Survey® (PMMS®), showing the 30-year fixed-rate mortgage (FRM) averaged 6.32 percent.

“Following the release of a stronger-than-expected September jobs report, the 30-year fixed rate mortgage saw the largest one-week increase since April,” said Sam Khater, Freddie Mac’s Chief Economist. “However, we should remember that the rise in rates is largely due to shifts in expectations and not the underlying economy, which has been strong for most of the year. Although higher rates make affordability more challenging, it shows the economic strength that should continue to support the recovery of the housing market.”

- The 30-year FRM averaged 6.32 percent as of October 10, 2024, up from last week when it averaged 6.12 percent. A year ago at this time, the 30-year FRM averaged 7.57 percent.

- The 15-year FRM averaged 5.41 percent, up from last week when it averaged 5.25 percent. A year ago at this time, the 15-year FRM averaged 6.89 percent.

The PMMS® is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20 percent down and have excellent credit.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link