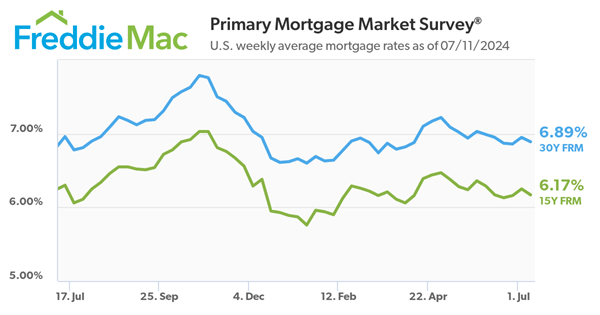

(July 11, 2024 ) Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing the 30-year fixed-rate mortgage (FRM) averaged 6.89 percent.

“Following June’s jobs report, which showed a cooling labor market, the 10-year Treasury yield decreased this week and mortgage rates followed suit,” said Sam Khater, Freddie Mac’s Chief Economist. “We’re also seeing more inventory on the market, including a fair number of listings with price cuts, which is an encouraging sign for prospective buyers.”

- The 30-year FRM averaged 6.89 percent as of July 11, 2024, down from last week when it averaged 6.95 percent. A year ago at this time, the 30-year FRM averaged 6.96 percent.

- The 15-year FRM averaged 6.17 percent, down from last week when it averaged 6.25 percent. A year ago at this time, the 15-year FRM averaged 6.30 percent.

The PMMS® is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20 percent down and have excellent credit.

Reaction from Dr. Jessica Lautz, Deputy Chief Economist and Vice President of Research at the National Association of REALTORS®.

Facts: The 30-year fixed mortgage rate from Freddie Mac declined to 6.89% over the last week from 6.95%. At 6.89%, with 20% down, a monthly mortgage payment on a home of $400,000 is $2,105; with 10% down, it is $2,369.

Positive: The CPI retreated today. Importantly, shelter, which is a lagging component but more than one-third of CPI, had slower gains. Fed Chair Jerome Powell indicated to Congress yesterday that there is a path to lowering the Fed Funds rate if inflation continues to cool. Today’s reading showed a measure of cooling.

Negative: Yesterday, Powell indicated “we probably won’t go back” to the ultralow rates seen in the last 10-15 years. For those thinking of mortgage interest rates—the implication has a ripple effect—buyers waiting for mortgage rates to again be at once-in-a-lifetime lows are likely going to be waiting a very long time.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link