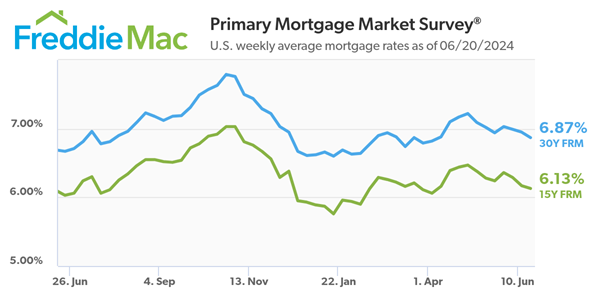

June 20, 2024, Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing the 30-year fixed-rate mortgage (FRM) averaged 6.87 percent.

“Mortgage rates fell for the third straight week following signs of cooling inflation and market expectations of a future Fed rate cut,” said Sam Khater, Freddie Mac’s Chief Economist. “These lower mortgage rates coupled with the gradually improving housing supply bodes well for the housing market. Aspiring homeowners should remember it’s important to shop around for the best mortgage rate as they can vary widely between lenders.”

- The 30-year FRM averaged 6.87 percent as of June 20, 2024, down from last week when it averaged 6.95 percent. A year ago at this time, the 30-year FRM averaged 6.67 percent.

- The 15-year FRM averaged 6.13 percent, down from last week when it averaged 6.17 percent. A year ago at this time, the 15-year FRM averaged 6.03 percent.

The PMMS® is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20 percent down and have excellent credit.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link