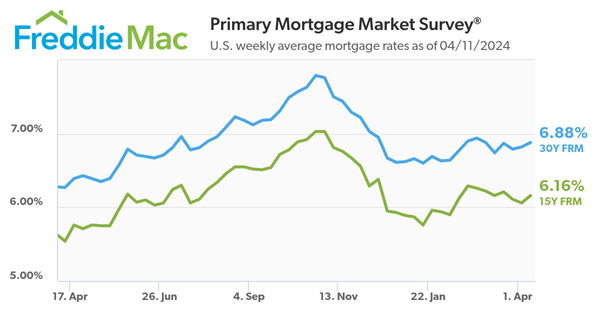

Freddie Mac released Thursday (04/11/2024) the results of its Primary Mortgage Market Survey® (PMMS®), showing the 30-year fixed-rate mortgage (FRM) averaged 6.88 percent.

“Mortgage rates have been drifting higher for most of the year due to sustained inflation and the reevaluation of the Federal Reserve’s monetary policy path,” said Sam Khater, Freddie Mac’s Chief Economist. “While newly released inflation data from March continues to show a trend of very little movement, the financial market’s reaction paints a far different economic picture. Since inflation decelerated from 9% to 3% between June 2022 and June 2023, the annual growth rate of inflation has remained effectively flat, ranging from 3.1% to 3.7% and averaging 3.3%. The March estimate of 3.5% annual growth is in the middle of that range. However, the market’s reaction was dramatically different, as illustrated by a significant drop in the Dow Jones Industrial Average post-announcement.”

Khater continued, “It’s clear that while the trend in inflation data has been close to flat for nearly a year, the narrative is much less clear and resembles the unrealized expectations of a recession from a year ago.”

- The 30-year FRM averaged 6.88 percent as of April 11, 2024, up from last week when it averaged 6.82 percent. A year ago at this time, the 30-year FRM averaged 6.27 percent.

- The 15-year FRM averaged 6.16 percent, up from last week when it averaged 6.06 percent. A year ago at this time, the 15-year FRM averaged 5.54 percent.

The PMMS® is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20 percent down and have excellent credit.

Instant Reaction: Dr. Jessica Lautz is the Deputy Chief Economist and Vice President of Research at the National Association of REALTORS®.

If one were to shake a Magic 8 ball, the answer to the question of “where are mortgage interest going to be in the next month?” would now read “outlook not so good.” Yesterday’s inflation figures, unfortunately, rose to 3.5%, which reverses the trend of lowering inflation. While yesterday showed a higher CPI reading and a jump in the 10-year treasury (the highest since November), the weekly average of mortgage interest rates remained in the mid-6% range at 6.88% as it has not yet fully factored in the jump. In the coming weeks, mortgage interest rates are likely to increase, which is disappointing news for Spring home buyers.

For a $400,000 home with a 10% down payment, the typical mortgage payment would be $2,366, which is out of reach for many Americans. While first-time buyers do not have housing equity to assist in their home purchase, those who have earned housing equity through home price appreciation are the current winners in today’s housing market. One-third of recent home buyers did not finance their home purchase last month—the highest share in a decade. For these buyers, interest rates may be less influential in their purchase decisions.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link