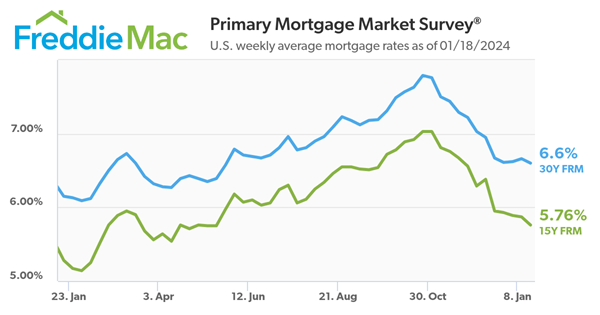

(Jan. 18, 2024) Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing the 30-year fixed-rate mortgage (FRM) averaged 6.60 percent.

“Mortgage rates decreased this week, reaching their lowest level since May of 2023,” said Sam Khater, Freddie Mac’s Chief Economist. “This is an encouraging development for the housing market and in particular first-time homebuyers who are sensitive to changes in housing affordability. However, as purchase demand continues to thaw, it will put more pressure on already depleted inventory for sale.”

- The 30-year FRM averaged 6.60 percent as of January 18, 2024, down from last week when it averaged 6.66 percent. A year ago at this time, the 30-year FRM averaged 6.15 percent.

- The 15-year FRM averaged 5.76 percent, down from last week when it averaged 5.87 percent. A year ago at this time, the 15-year FRM averaged 5.28 percent.

The PMMS® is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20 percent down and have excellent credit.

Here’s reaction from Dr. Jessica Lautz, Deputy Chief Economist and Vice President of Research at the National Association of REALTORS®.

Home buyers should be pleased with the continuing drop in mortgage interest rates this week. If they can find a home, they can lock in a mortgage interest rate of 6.60% this week, down from 6.66% last week. This is the lowest mortgage interest rate in eight months (May 2023 mortgage interest rates were 6.57%). The historical norm for mortgage interest rates since 1971 is 7.74%.

For a $400,000 home, the typical mortgage payment with a 20% down payment for a 6.6% mortgage interest rate would be $2,044. This is a monthly savings of $257 compared to when mortgage interest rates were at their recent high point in October 2023.

For potential home buyers, winter is often a time to set financial goals for the year ahead. If a home purchase is a financial goal on the horizon, this is the time to work on cleaning up finances and finding a mortgage broker and a REALTOR® to help with that pursuit. Home buyers, especially first-time buyers, can benefit from researching FHA, VA loans, and low down payment programs. These programs are often under home buyers’ radars and can put homeownership within reach.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link