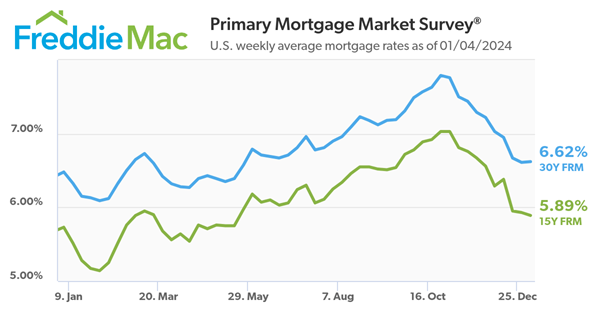

Freddie Mac today (01/04/2024) released the results of its Primary Mortgage Market Survey® (PMMS®), showing the 30-year fixed-rate mortgage (FRM) averaged 6.62 percent.

“Between late October and mid-December, the 30-year fixed-rate mortgage plummeted more than a percentage point. However, since then rates have moved sideways as the market digests incoming economic data,” said Sam Khater, Freddie Mac’s Chief Economist. “Given the expectation of rate cuts this year from the Federal Reserve, as well as receding inflationary pressures, we expect mortgage rates will continue to drift downward as the year unfolds. While lower mortgage rates are welcome news, potential homebuyers are still dealing with the dual challenges of low inventory and high home prices that continue to rise.”

- The 30-year FRM averaged 6.62 percent as of January 4, 2024, up slightly from last week when it averaged 6.61 percent. A year ago at this time, the 30-year FRM averaged 6.48 percent.

- The 15-year FRM averaged 5.89 percent, down from last week when it averaged 5.93 percent. A year ago at this time, the 15-year FRM averaged 5.73 percent.

The PMMS® is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20 percent down and have excellent credit.

Instant Reaction From Dr. Jessica Lautz, Deputy Chief Economist and Vice President of Research at the National Association of REALTORS®.

Mortgage interest rates remained nearly flat as the new year began. After mortgage rates dropped incrementally for 9 weeks, they increased a hair to 6.62% from 6.61%. The weekly change in mortgage rates does not yield a meaningful change in what the typical monthly mortgage payment would be for a $400,000 home, just $2 per month—a payment of $2,048 (The median NAR existing-home price was $387,600 in November and the median new sales price was $434,700).

The overall trajectory of mortgage interest rates in 2024 is expected to decrease. While mortgage interest rates ease, there will be weekly shifts in the average rate. As home buyers move forward into the spring market, staying closely attuned with the mortgage broker can help them navigate the best rate. Additionally, buyers’ personal financials do influence the mortgage interest rate they will have—working on their debt-to-income ratio and credit score can help.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link