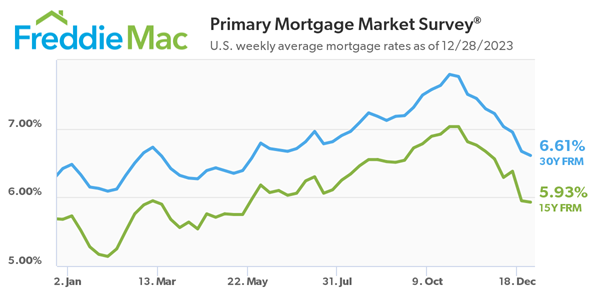

Freddie Mac today (12-28-2023) released the results of its Primary Mortgage Market Survey® (PMMS®), showing the 30-year fixed-rate mortgage (FRM) averaged 6.61 percent.

“The rapid descent of mortgage rates over the last two months stabilized a bit this week, but rates continue to trend down,” said Sam Khater, Freddie Mac’s Chief Economist. “Heading into the new year, the economy remains on firm ground with solid growth, a tight labor market, decelerating inflation, and a nascent rebound in the housing market.”

- The 30-year FRM averaged 6.61 percent as of December 28, 2023, down from last week when it averaged 6.67 percent. A year ago at this time, the 30-year FRM averaged 6.42 percent.

- The 15-year FRM averaged 5.93 percent, down from last week when it averaged 5.95 percent. A year ago at this time, the 15-year FRM averaged 5.68 percent.

The PMMS® is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20 percent down and have excellent credit.

Here’s Reaction from Dr. Jessica Lautz, Deputy Chief Economist and Vice President of Research at the National Association of REALTORS®.

Mortgage interest rates continued their decline this week and have hit the lowest level in six months since May of 2023. Mortgage interest rates are now at an average of 6.61%, easing from 6.67% last week. The typical monthly mortgage payment for a $400,000 home is now at $2,046. While NAR’s Pending Home Sales shows flat data from October to November, the recent week’s rate decline should motivate buyers who had been priced out of the market.

There are many signs of encouragement heading into 2024 in the housing market, such as more housing inventory from home builders, lower mortgage interest rates, and demographics. This year, even the youngest baby boomer (born between 1946 and 1964) turned 60 years of age. Baby boomers are the largest share of home buyers and may be looking for their retirement property. Last year, half of older boomers paid all cash for their homes and are less concerned with mortgage interest rates. Additionally, millennials (the largest adult generation) may be looking for their first property or a move-up family home. Housing demand is apparent. With added inventory and better mortgage interest rates, 2024 looks like a better year.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link