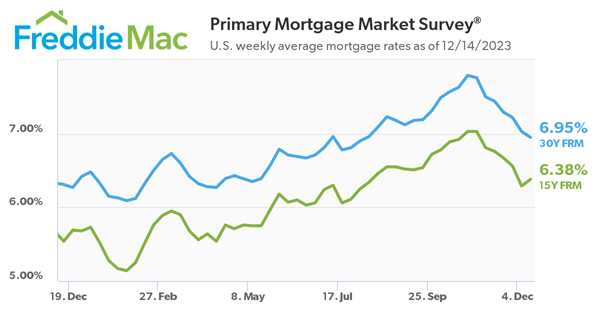

Freddie Mac today (12/14/2023) released the results of its Primary Mortgage Market Survey® (PMMS®), showing the 30-year fixed-rate mortgage (FRM) averaged 6.95 percent.

“Potential homebuyers received welcome news this week as mortgage rates dropped below seven percent for the first time since August,” said Sam Khater, Freddie Mac’s Chief Economist. “Given inflation continues to decelerate and the Federal Reserve Board’s current expectations that they will lower the federal funds target rate next year, we likely will see a gradual thawing of the housing market in the new year.”

- The 30-year FRM averaged 6.95 percent as of December 14, 2023, down from last week when it averaged 7.03 percent. A year ago at this time, the 30-year FRM averaged 6.31 percent.

- The 15-year FRM averaged 6.38 percent, up from last week when it averaged 6.29 percent. A year ago at this time, the 15-year FRM averaged 5.54 percent.

The PMMS® is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20 percent down and have excellent credit.

Here’s reaction to today’s PMMS release from Dr. Jessica Lautz is the Deputy Chief Economist and Vice President of Research at the National Association of REALTORS®.

For the first time since August, interest rates for a 30-year fixed mortgage have dropped below 7%, hitting 6.95% this week. This brings the monthly mortgage payment for a home priced at $400,000 to $2,118. This is down from a recent high this Autumn of 7.79% and yields monthly savings of $183 and $2,196 annually for the same $400,000 home.

The Fed indicated yesterday that they will hold the Fed Funds Rate steady for now and cut rates three times in 2024. This is all welcome news for potential home buyers and sellers, as mortgage interest rates will decrease. NAR forecasts that mortgage interest rates will average 6.3% in 2024.

While the lock-in effect of higher mortgage rates has stalled the real estate market in 2023, the momentum is moving in the right direction for stronger sales activity in 2024. Will it be a traditional Spring real estate market, or will it start to heat up in the Winter months as rates decline? Let’s also hope the lower mortgage interest rates translate into stronger homebuilder activity, as inventory will be needed as buyers move from the sidelines. For serious buyers, the time is now to get your financial house in order, find a REALTOR® and start your research. Maybe it won’t be a new home for the holidays, but Valentine’s Day is right around the corner.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link