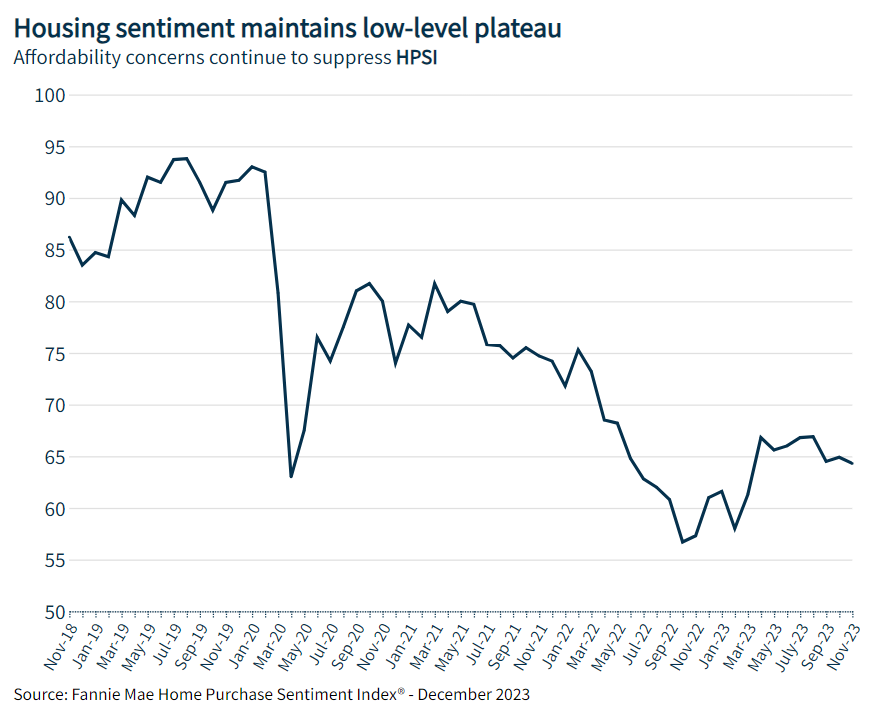

The Fannie Mae Home Purchase Sentiment Index® (HPSI) released today saw a 0.6-point decline in November, maintaining a low-level plateau established in the first half of 2023. The latest survey reveals a growing pessimism among consumers, with only 14% considering it a favorable time to buy a home, marking a new low. Respondents continue to anticipate rising home prices and mortgage rates over the next year. Despite an overall 7.0-point increase compared to the previous year, the HPSI remains subdued.

Doug Duncan, Fannie Mae’s Senior Vice President and Chief Economist, notes persistent consumer skepticism about the housing market’s health. The survey highlights a shift in sentiment, as earlier optimism about declining home prices waned throughout 2023. Affordability challenges, coupled with concerns over household finances, drive this subdued sentiment. Duncan predicts a slow recovery, citing the ongoing housing inventory shortage and projecting a return to pre-pandemic sales levels in a couple of years.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link